There may be one know-how that has created a buzz all around the world, and it’s unstoppable within the monetary ecosystem. This blockchain know-how has revolutionized the way in which we transact by eliminating the necessity for intermediaries and enabling peer-to-peer transactions.

The introduction of Central Financial institution Digital Foreign money has added a brand new dimension to blockchain’s superior cost strategies. Central banks throughout the globe have began collaborating in transforming their current monetary methods to enrich the digital age.

Nonetheless, CBDC will not be effectively understood. Learn this whole weblog until the tip to get a greater understanding of CBDC and never miss each minute of element.

What’s a Central Financial institution Digital Foreign money (CBDC)?

The Central Financial institution Digital Foreign money is a type of centralized digital foreign money that’s issued by the nation’s central financial institution. They’re extra possible just like cryptocurrencies, apart from the truth that their worth is fastened by the central financial institution. They’re thought of equal to the nation’s fiat foreign money.

In India, CBDC is often known as the ‘Digital Rupee’ or e₹“. It’s introduced by the RBI as a digital tender issued by the central financial institution. Now, digital rupees function the identical stability as bodily money. It builds belief, security, and the settlement of transactions digitally.

What’s the fundamental focus of CBDC?

CBDC is principally working to ease companies and shoppers with privateness, accessibility, comfort, and fund safety. With CBDCs, the price of upkeep can also be lowered considerably. It maintains clean transferability in advanced monetary methods and in addition diminishes cross-border transaction prices.

CBDC’s implications eradicate the risk that’s related to digital currencies and their utilization. Cryptocurrencies are identified for his or her unstable conduct, as their worth consistently fluctuates. whereas CBDCs are directed and ruled by the central banks of nations, with a way of safety and ease of trade.

What are the widespread kinds of CBDC?

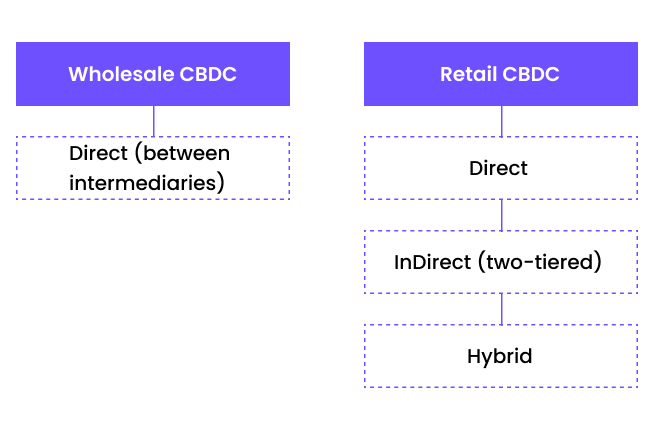

Basically, there are two kinds of main CBDCs out there: wholesale and retail. Customers and companies desire retail CBDCs, and monetary establishments and bigger enterprises select wholesale CBDCs.

Retail CBDCs are digital currencies which can be ruled and backed by the central authorities and provided to shoppers and companies. The usage of these currencies eliminates the chance of middleman fraud. Right here, shoppers can’t lose their belongings, and no digital foreign money issuer would possibly turn into bankrupt.

There are two kinds of retail CBDCs: token-based retail CBDCs and account-based retail CBDCs. Token-based retail CBDCs are accessible with each personal and public keys. As a result of this technique, customers could make nameless transactions simply. Account-based retail CBDCs guarantee digital identification to channelize accounts.

Wholesale CBDCs maintain reserves in a central financial institution. Right here, the central financial institution simply grants wholesale CBDC transactions and deposits funds to settle and interexchange cash. Central banks are free to set their rates of interest, financial coverage instruments, reserve necessities, or balances.

What are the widespread fashions of CBDC issuance?

Middleman CBDC Mannequin

An account-based CBDC method requires the involvement of a trusted third-party verifier to confirm the account holder and regulate the account stability earlier than they begin making funds.

Token-based CBDC verification makes use of blockchain know-how to override the necessity for previewing balances earlier than permitting transactions. These processes present a extra direct method with out the necessity for an account.

What are the numerous benefits related to CBDC?

1. Improved and Environment friendly Transaction

1. This could result in monetary disintermediation

CBDCs may result in unemployment as they eradicate the necessity for monetary intermediaries, like banks and different establishments.

2. Danger of financial institution runs and instability

As CBDC demand is hyping, it may trigger incapacity to the monetary system and should lead banks to flee and run.

3. Requirement of funds for funding

The implementation of CBDCs requires technological investments and infrastructure funding to set it up effectively.

4. Susceptible to cybercrimes

Just like different on-line digital methods, CBDCs are susceptible to cyberattacks and hacking.

5. Menace to consumer privateness and surveillance creation

Primarily based on the CBDC design, there’s a threat concerned in consumer privateness, and the institution may very well be used for surveillance.

6. Challenges with cross-border transactions

The acceptance of CBDC may trigger hindrances and issue within the implementation of cross-border transactions and regulatory harmonization.

7. Could cause an earnings hole

If the distribution of CBDCs doesn’t occur equitably, it may create earnings inequality at massive.

8. Much less availability of bodily money

CBDCs are totally practical solely on digital infrastructure. They’re susceptible to energy outages and different kinds of disruptions.

9. Difficult to implement anti-money laundering measures

CBDCs should not potent sufficient to trace bodily money, which may result in the rise of cash laundering and terrorist acts.

10. Share command with the central financial institution

The design of CBDCs shares all regulatory energy with central banks, which might manipulate the financial system by making selections that go in opposition to society’s pursuits.

What initiative did CBDC absorb India?

By the tip of 2022, RBI had launched a pilot ‘e-Rupee’. It was launched to construct a digital model just like paper foreign money, making certain a seamless transition to CBDC.

Beginning with eight banks within the nation, the RBI is approaching digital foreign money utilizing the middleman mannequin.

In February 2023, this mission was launched in 5 cities inside closed teams based mostly on invites solely. Beneath this mission, RBI points CBDCs to intermediaries for giving digital wallets to finish customers.

The mode of transaction can be just like bodily foreign money.

Listed below are some RBI plans which can be included into e-rupee:

1: It features offline, supporting the utilization of CBDC with little to no networking.

2: It packages below restricted authorities utilization and has an outlined goal.

3: It’s straightforward to undertake, makes use of each new and legacy cost methods, and operates easily.

4: It ensures the precise to privateness when it comes to bodily money.

What sort of expertise do finish customers get with CBDC?

The E-wallet interface conveniently permits front-end options by performing as a catalyst for CBDC adoption.

Account creation requires private info, id verification, and the institution of authenticated technique of accessing the pockets.

Administration of accounts wants sturdy id, accessibility, and the elimination of fraud and cybersecurity. 3-step verification works on KYC, consumer self-registration, and Aadhar-based OTP verification.

On this course of, customers must hyperlink any of the onboarded banks to load and unload CBC tokens from their checking account.

Customers can simply examine their account’s stability and denomination of tokens utilizing wallets. With this, customers can simply monitor their transaction historical past, particular person funds, and acknowledgments.

Having token administration permits counterfeiting, auto-locking, and freezing of accounts. Moreover, the potential vulnerabilities and safeguards may be simply saved in worth tokens.

Customers can simply make purchases at retailers by paying into CBDCs. Now customers have two choices when it comes to sending CBDC: scanning the QR code or coming into a cellular quantity.

Customers can simply obtain CBDCs via digital wallets. They will additionally settle for CBDC utilizing peer-to-peer transactions or central bank-regulated platforms.

What are the foremost key concerns for growing adoption and utilization?

Anonymity: CBDC expects a tiered anonymity framework utilizing the edge worth of the transaction.

Knowledge Privateness: CBDC requires stronger information privateness frameworks based mostly on prioritizing information assortment.

Resilience: Constructed a layer of risk-control fraud safety and compliance.

Scaling up infrastructure: CBDC requires controllable decentralization, emphasizing modular structure and an elevated framework.

Operational Effectivity: CBDC requires operational capability by organising guidelines and a distribution layer based mostly on computing.

Which international locations have launched their piloted CBDCs?

- Bahamas: Sand Greenback, launched in October 2020

- Cambodia: Bakong, retail, launched October 2020

- Antigua and Barbuda: DCash, launched March 2021

- Grenada: DCash, launched March 2021

- Nigeria: e-Naira, launched October 2021

- Dominica: DCash, launched in December 2021

- Ghana (Financial institution of Ghana): e-Cedi

- Sweden: e-Kronam

- Central Financial institution of the Islamic Republic of Iran

- Kazakhstan (Nationwide Financial institution of Kazakhstan): Digital Tenge

- Russia (Financial institution of the Russian Federation): Digital Ruble

- South Korea (Financial institution of Korea)

- Saudi Arabia (Saudi Central Financial institution)

- Central Financial institution of the United Arab Emirates

- Singapore (Financial Authority of Singapore)

- South Africa (South African Reserve Financial institution)

- India (Reserve Financial institution of India): Digital Rupee

- China (Folks’s Financial institution of China): e-CNY

- Japan (Financial institution of Japan): Digital Yen

- Hong Kong: e-HKD

- Thailand (Financial institution of Thailand)

- Australia (Reserve Financial institution of Australia)

- France (Banque de France)

- Brazil (Banco Central do Brasil): Digital Actual

- Uruguay (Central Financial institution of Uruguay): e-Peso

- Philippines (Bangko Sentral ng Pilipinas)

- Central Financial institution of the Republic of Turkey

- Norway (Norges Financial institution)

- Venezuela: Digital Bolivar

- Bahrain (Central Financial institution of Bahrain)

- Bhutan (Royal Financial Authority of Bhutan)

All in all

CBDC has the potential to channel a number of advantages to the monetary system. Although there are challenges and drop downs concerned, with cautious planning it may set up a profitable monetary system.

FAQs

What are CBDCs?

CBDC stands for Central Financial institution digital foreign money. It is usually often called “e-rupee.”It’s a authorized tender precisely just like paper foreign money accepted and assigned by the central financial institution of the nation.

Is CBDC just like bitcoin/ cryptocurrencies?

No. CBDC is a digital type of foreign money, just like bitcoins or crypto. Nonetheless, it has a set intrinsic worth that’s ruled and controlled by the central financial institution of the nation. However bitcoin‘s worth is unstable by nature; it retains fluctuating.

What are the dangers concerned with CBDC?

CBDC is susceptible to cyberattacks; this method may be simply breached. It additionally makes use of a centralized database system that doubtlessly dangers the privateness of customers. Its affect is foreseen over conventional banking, which may result in monetary instability.

How are CBDCs completely different from UPI and different modes of fund switch?

CBDCs are a type of digital foreign money that’s assigned and ruled by the central financial institution of the county. Whereas UPI or different fund switch modes are the type of cost

I’m the CEO and founding father of Blocktech Brew, a workforce of blockchain and Internet 3.0 specialists who’re serving to companies undertake, implement and combine blockchain options to attain enterprise excellence. Having efficiently delivered 1000+ tasks to purchasers throughout 150+ international locations, our workforce is devoted to designing and growing good options to scale your enterprise progress. We’re targeted on harnessing the facility of Internet 3.0 applied sciences to supply world-class blockchain, NFT, Metaverse, Defi, and Crypto growth companies to companies to assist them obtain their objectives.