Bitcoin Money’s hash price soared to a yearly excessive this week after an unknown miner captured round 90% of its blocks inside two days.

This surge comes because the community’s native BCH token hit a four-month low following a broader market crash and the defunct Mt. Gox BCH reimbursement plans.

Phoenix mines 90% of BCH blocks

In line with 2miners information, the Bitcoin Money community noticed a large hash price surge between July 2 and July 4, rising from 3.6 EH/s to a yearly excessive of 9.4 EH/s earlier than declining again to the weekly common of three.3 EH/s as of press time.

The hash price is a crucial measure of a blockchain community’s well being. It measures the computational energy used to mine and course of transactions. The next hash price means a safer community, requiring extra computational energy to change the blockchain and making it extra proof against assaults.

Conversely, a decrease hash price signifies much less computational energy for mining and processing transactions, lowering the community’s total safety.

So, whereas BCH’s dramatic bounce in hash price excited the crypto neighborhood, it additionally sparked hypothesis about its causes and implications for the community.

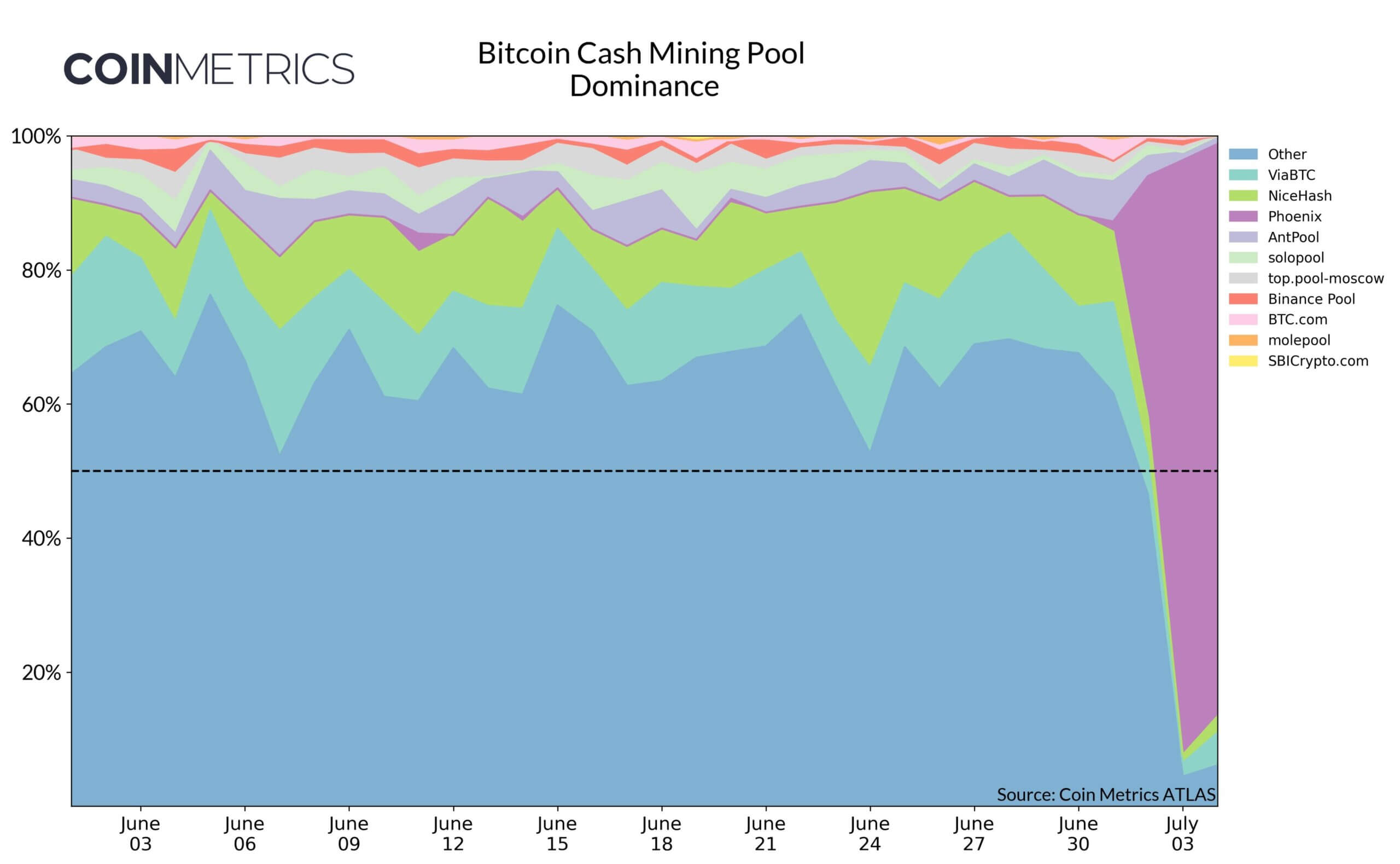

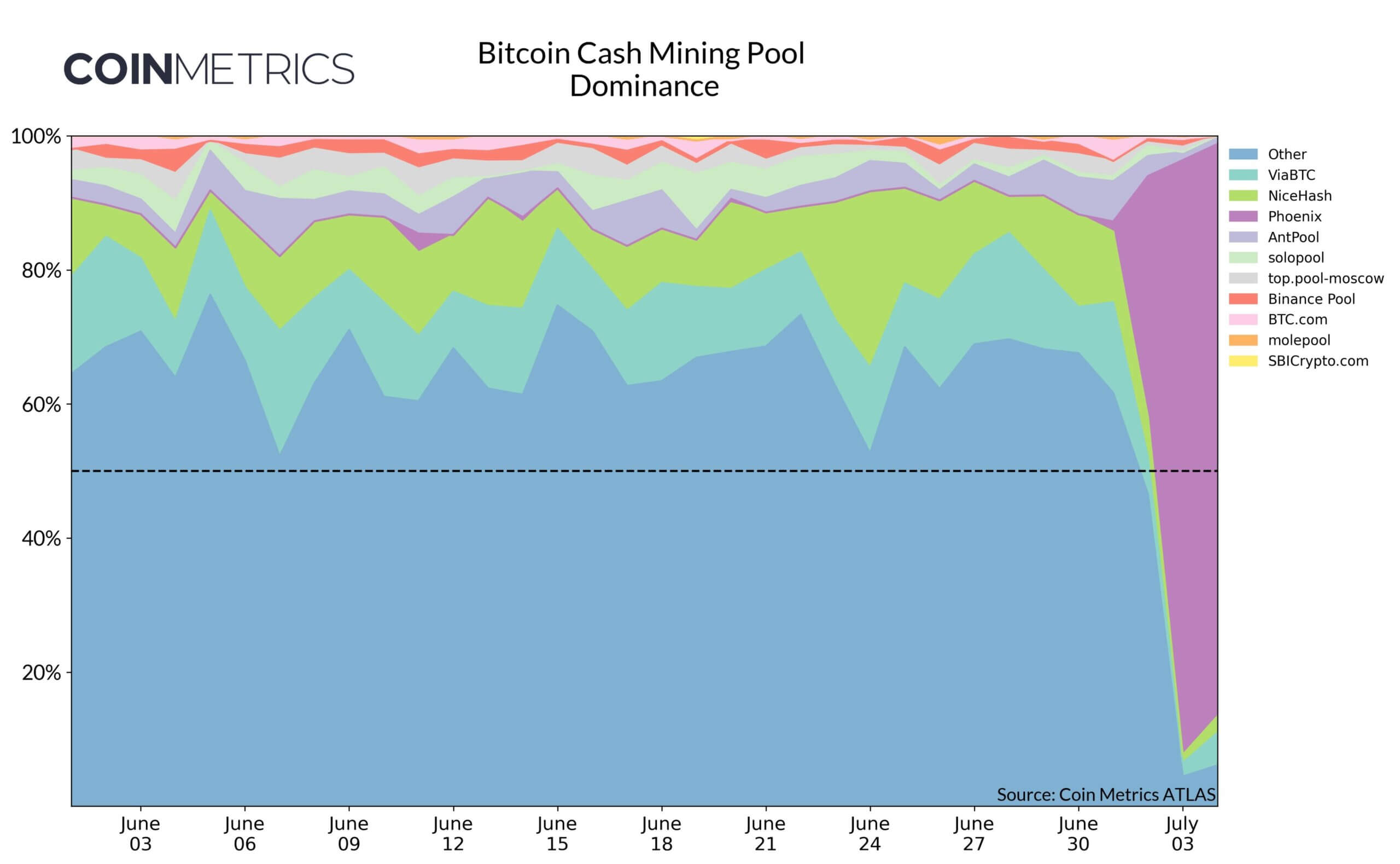

The Bitcoin Money Podcast attributed the surge to a brand new miner named “Phoenix, ” which captured many of the new BCH provides. Information reveals this miner produced about 90% of the blocks throughout these two days, although its dominance has fallen to 29% at press time.

Parker Merritt, a researcher at CoinMetrics, supported this view. He prompt the miner was linked to the Phoenix Group, an Abu Dhabi-listed Bitcoin mining firm that not too long ago launched a mining pool service for BTC and BCH networks.

Additional, Merritt famous that Phoenix’s actions is perhaps an try to spotlight the “dangers of mining centralization.”

Value declines to 4-month low

Bitcoin Money mining points surfaced when the community’s native BCH token plunged to a four-month low of $305.

Market observers attributed the decline to the broader market decline that noticed main digital property like Bitcoin fall by round 7% up to now day to beneath $55,000. On the similar time, Ethereum additionally misplaced the $3,000 mark throughout the reporting interval.

Moreover, Merrit identified that BCH’s worth would possibly face heavy promoting exercise as Phoenix won’t HODL their earnings.