As economies develop, so does the demand for commodities, and ultimately the demand outstrips provide. That results in rising commodity costs, however the commodity producers don’t initially reply to the upper costs as a result of they’re not sure whether or not they’ll final. Because of this, the hole between demand and provide continues to widen, protecting upward stress on costs.

Ultimately, costs get so engaging that producers reply by making further investments to spice up provide, narrowing the availability and demand hole. Excessive costs proceed to encourage funding till lastly, provide overtakes demand, pushing costs down. However whilst costs fall, provide continues to rise as investments made in the course of the increase years bear fruit. Shortages flip to gluts and commodities enter the bearish a part of the cycle.

There have been a number of commodity tremendous cycles all through the course of historical past. The latest one began in 1996 and peaked in 2011, pushed by uncooked materials demand from speedy industrialization going down in markets like Brazil, India, Russia and particularly, China.

We will speak concerning the cyclical nature of commodities basically, however we will additionally choose sure commodities to see whether or not they’re on the upswing or downswing.

Sprott not too long ago did that, stating that A new copper supercycle is rising, constructed on a number of rising geopolitical and market traits, together with electrification, nationwide safety issues, environmental coverage, provide constraints and deglobalization.

We agree. Beneath are 5 the reason why we’re getting into the following copper supercycle.

Demand surge

Copper is without doubt one of the most necessary metals with greater than 20 million tonnes consumed every year throughout quite a lot of industries, together with constructing building (wiring & piping,) energy era/ transmission, and digital product manufacturing.

In recent times, the worldwide transition in the direction of clear vitality has stretched the necessity for the bottom metallic even additional.

Merely put, electrification doesn’t occur with out copper, the heartbeat of the worldwide vitality economic system.

Together with the standard functions in building wiring and plumbing, transportation, energy transmission and communications, there may be now added demand for copper in electrical autos and renewable vitality methods.

Thousands and thousands of toes of copper wiring might be required for strengthening the world’s energy grids, and tons of of hundreds of tonnes extra are wanted to construct wind and photo voltaic farms. Electrical autos use triple the quantity of copper as gasoline-powered vehicles. There’s greater than 180 kg of copper within the common dwelling.

Extra copper is being demanded by the electrification of public transportation methods, 5G and AI.

Provide crunch

Nonetheless, among the world’s largest mining corporations, market evaluation corporations and banks, are warning that by 2025, a large shortfall will emerge for copper, which is now the world’s most crucial metallic as a consequence of its important function within the inexperienced economic system.

The deficit might be so massive, The Monetary Submit acknowledged, that it may maintain again world development, stoke inflation by elevating manufacturing prices, and throw world local weather objectives off target.

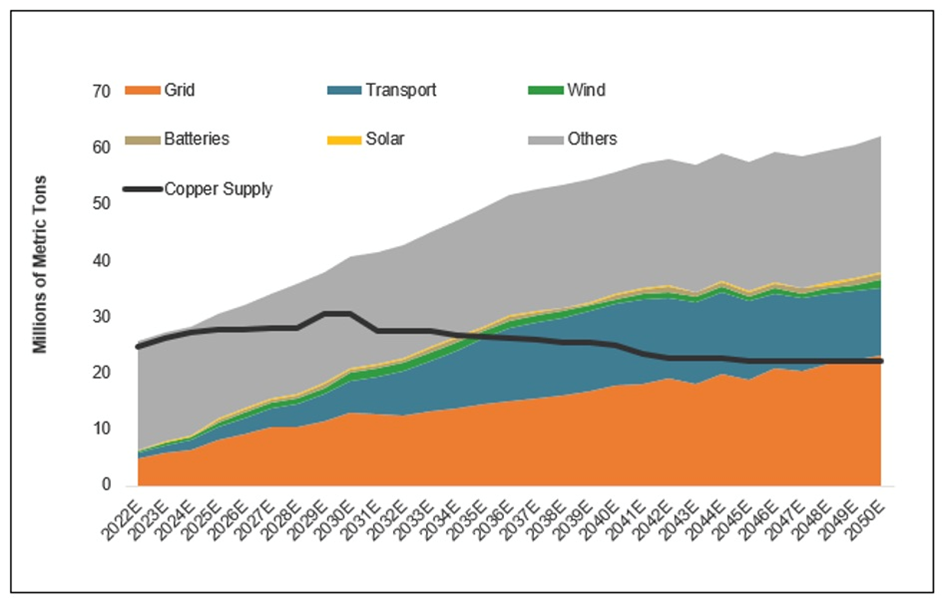

The graph beneath exhibits provide not maintaining with demand. Two causes recognized by Sprott: growing a brand new copper mine is prolonged and costly, usually taking on a decade from exploration to manufacturing; and the mining sector has seen lengthy intervals of underinvestment, when low copper costs meant diminished exploration budgets and fewer discoveries.

There has additionally been an overdependence on mergers and acquisitions. It’s a lot simpler for a copper mining firm to extend its reserves by buying a smaller firm (and its reserves), than dedicating capital to greenfield exploration, which is pricey and dangerous.

In accordance with Sprott, counting on M&A over new discoveries could sluggish the trade’s provide response to cost indicators and result in extended market tightness, supporting a bullish outlook for the copper market.

Supply: BloombergNEF Transition Metals Outlook 2023. The black line represents provide and the shaded areas symbolize demand. Demand is predicated on a net-zero state of affairs, i.e., world net-zero emissions by 2050 to satisfy the objectives of the Paris Settlement.

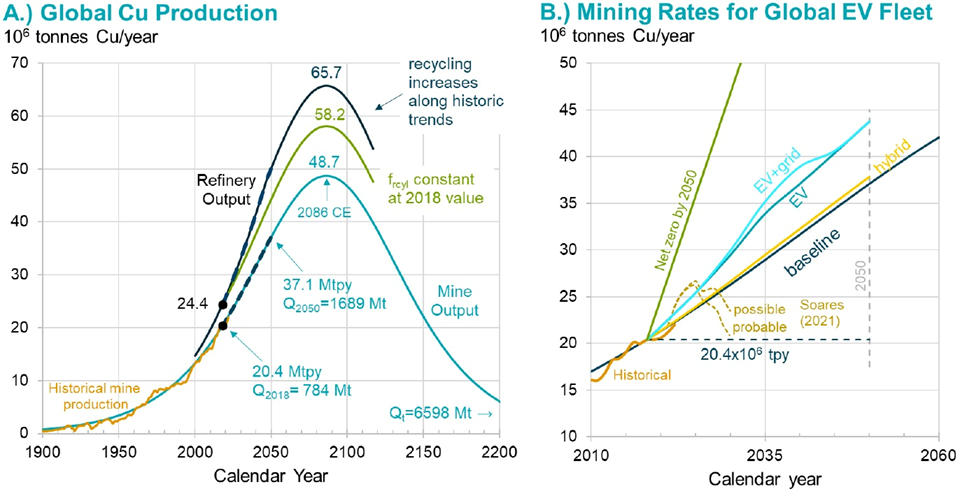

The diploma to which the trade has did not carry on new mines is clear in a new research by the College of Michigan and Cornell College. The researchers discovered that copper can’t be mined quick sufficient to maintain up with present US coverage pointers to make the transition from fossil-fueled energy and transportation to electrical autos and renewable energies.

For instance the Inflation Discount Act requires 100% of latest vehicles to be electrical autos by 2035.

“A standard Honda Accord wants about 40 kilos of copper. The identical battery electrical Honda Accord wants nearly 200 kilos of copper. Onshore wind generators require about 10 tons of copper, and in offshore wind generators, that quantity can greater than double,” stated Adam Simon, co-author of the paper, revealed by the Worldwide Vitality Discussion board (IEF). “We present within the paper that the quantity of copper wanted is basically inconceivable for mining corporations to supply.”

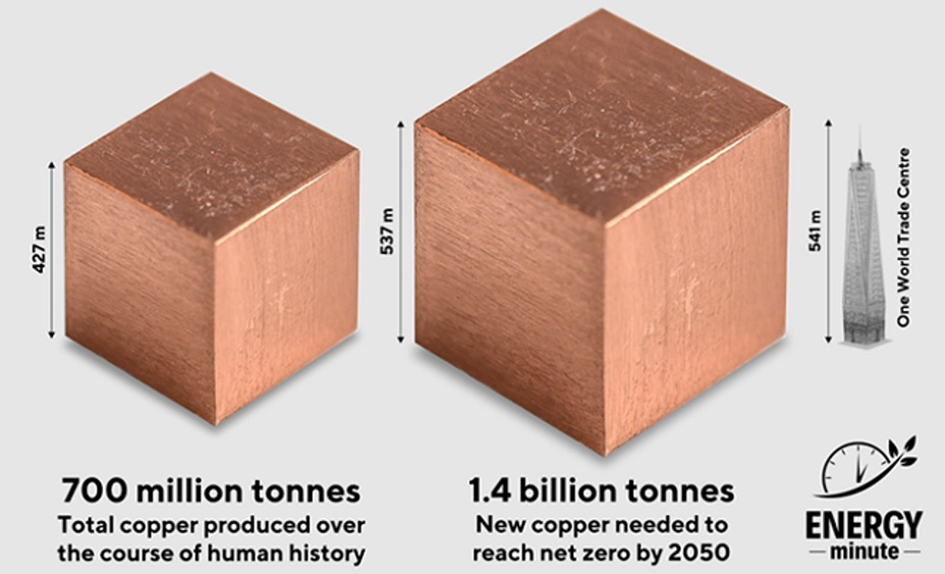

How inconceivable? The researchers discovered between 2018 and 2050, the world might want to mine 115% extra copper than has been mined in all human historical past to 2018. This might meet our present copper wants and help the growing world with out contemplating the inexperienced vitality transition.

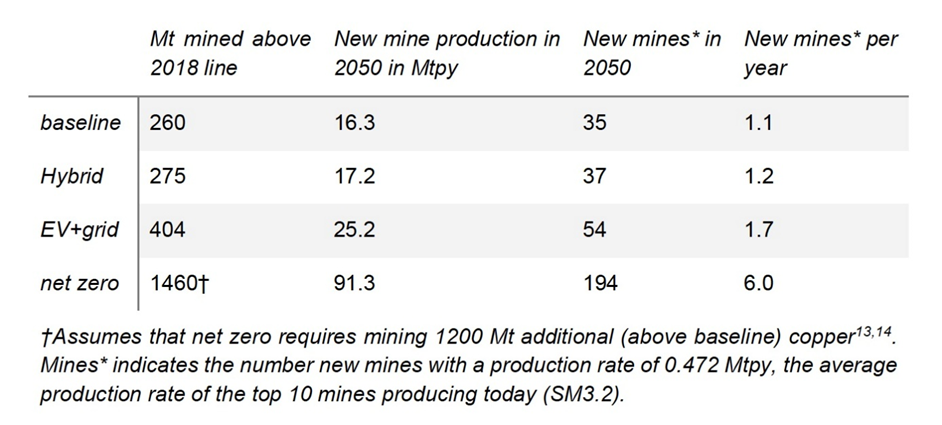

To impress the worldwide car fleet requires bringing into manufacturing 55% extra new mines. Between 35 and 195 massive new copper mines must be constructed over the following 32 years, at a price of as much as six mines per 12 months. In different phrases, inconceivable. In closely regulated environments like the US and Canada, it might take as much as 20 years to construct one mine from scratch.

As an alternative of totally electrifying the US fleet of autos, Simon suggests specializing in manufacturing hybrid autos, which require far much less copper than electrical autos — 29 kg vs 60 kg.

Going this route wouldn’t require main grid enhancements and would have nearly as massive an influence on lowering CO2 emissions, the research discovered. Additionally, the chance of discovering the copper wanted to make hybrids is far better than for electrical autos.

Almost 600,000 tonnes of copper provide didn’t come to market final 12 months as a result of Panama authorities’s closure of Cobre Panama, and a strike on the Las Bambas copper mine in Peru.

Anglo-American says its 2024 Chilean manufacturing will disappoint, at between 210,000 and 270,000 tonnes owing to move grade declines and logistical points at its Los Bronces mine. (Goehring & Rozencwajg)

Chile’s copper output has been dented by a long-running drought within the nation’s arid north. Codelco’s 2023 manufacturing was the bottom in 25 years. Chile in April registered its lowest month of copper manufacturing in additional than a 12 months, regarding for the world’s largest copper producer. Mines produced 6.7% lower than in March and 1.5% much less that April 2023.

Useful resource nationalism

The time period “useful resource nationalism” is loosely outlined because the tendency of individuals and governments to claim management, for strategic and financial causes, over pure assets positioned on their territory.

Whereas it presents alternatives for these in much less developed international locations to hunt revenue from their pure assets, state possession can exacerbate the instability of the world’s crucial minerals provide.

The Sprott report notes that [export] bans and tariffs, political instability and rising useful resource nationalism in copper-producing areas can disrupt provide chains and price buildings, main to cost spikes.

Deglobalization and rising geopolitical tensions improve dependence on native provide chains and ramp up army expenditures, spurring copper demand.

Two latest examples of copper useful resource nationalism passed off in Peru and Panama.

The world’s second-largest copper producer in 2023 was racked by protests owing to a change of presidency. Final November, a strike on the Las Bambas, copper mine threatened ~250,000 tonnes of annual manufacturing.

Additionally late final 12 months, the federal government of Panama ordered First Quantum Minerals to close down its Cobre Panama operation, eradicating almost 350,000 tonnes of copper from world provide.

Environmental issues

The transition to wash vitality has the cleanup of air air pollution as its objective. Copper is without doubt one of the most necessary metals wanted to push this transition, and but environmental issues usually get in the best way of latest mines.

“Copper miners face stringent environmental laws associated to land use, air pollution management and conservation. These probably delay new initiatives,” states the Sprott report.

In a latest article, Barron’s factors to the Nationwide Environmental Coverage Act as a chunk of laws that makes the allowing course of for main mining and vitality infrastructure initiatives troublesome to navigate. Whereas the Biden administration and Congressional leaders are attempting to reform the allowing course of, Barron’s notes it received’t assist the mining initiatives that entered allowing earlier than the brand new one- to two-year cut-off dates had been imposed. This contains the Decision copper mine in Arizona, the Rhyolite Ridge lithium-boron mission, and the Stibnite gold mission.

Inflation

A rally in Could carried copper costs to a document excessive of $5.20/lb. Regardless of a latest pullback, costs are 13% greater year-to-date amid speculative bets of looming shortages. (Buying and selling Economics)

The Federal Reserve this week froze rates of interest on the present 5.25-5.5%, and stated there would probably solely be one quarter-point rate of interest discount by 12 months’s finish as an alternative of two. Inflation dropped two-tenths of a share level in Could (3.6%) in comparison with April (3.4%) — nonetheless a great distance from the Fed’s 2% goal.

In accordance with gold and copper bull Peter Schiff, Excessive inflation and a provide scarcity are conspiring with elevated demand for electrical autos, a increase in renewable vitality tech, and an AI bubble to maintain the worth going up even with out the flood of speculative cash.

Schiff believes that even when impractical “internet zero” targets are revised all the way down to extra real looking figures, the demand will nonetheless be there, and the present provide squeeze and inflationary pressures are right here to remain…

To keep away from a banking and business actual property disaster, the Fed may have no alternative however to chop rates of interest sooner or later. This will invite a brand new torrent of inflationary growth because the Fed ignores the stress cooker that its insurance policies helped create.

Conclusion

The entire above can solely imply one factor for copper: greater costs.

We already talked about the shutdown of Cobre Panama, a significant strike in Peru, and manufacturing misses in Chile contributing to provide issues.

As we reported in April, all 4 of Codelco’s megaprojects have been delayed by years, confronted price overruns totaling billions, and suffered accidents and operational issues whereas failing to ship the promised increase in manufacturing, in keeping with the corporate’s personal projections.

There are additionally issues about Zambia, Africa’s second largest copper producer, the place drought situations have lowered dam ranges, creating an influence disaster that threatens the nation’s deliberate copper growth.

Ivanhoe Mines reported a 6.5% quarterly drop in manufacturing on the world’s latest main copper mine, Kamoa-Kakula within the DRC.

The tightness of the copper focus market has been mirrored in therapy and refining costs plummeting from over $90 per tonne to beneath $10/t. This drastic discount compelled Chinese language smelters, chargeable for round half of world refined copper manufacturing, to contemplate a ten% manufacturing minimize.

In the meantime, copper demand continues to extend.

The graph beneath exhibits the demand for copper to 2050 is bigger than all the copper produced over the course of human historical past.

Whereas costs have been reaching among the many highest ranges of the previous 5 years, some consider that copper, and different commodities, have by no means been extra undervalued.

We all know one factor for positive. The case for all commodities rests upon the US greenback. As soon as the Fed begins chopping rates of interest, the greenback will weaken and your entire commodities advanced will strengthen.

Investing in juniors has traditionally been a great way to leverage rising metals costs.

Juniors personal the world’s future mines – they assist the majors to exchange the ore that they’re continuously depleting of their working mines, thereby serving to to beat the copper provide shortfall we all know is coming.

Authorized Discover / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter often known as AOTH.

Please learn your entire Disclaimer rigorously earlier than you utilize this web site or learn the publication. If you don’t comply with all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/publication/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/publication/article, and whether or not you really learn this Disclaimer, you might be deemed to have accepted it.

Any AOTH/Richard Mills doc is just not, and shouldn’t be, construed as a suggestion to promote or the solicitation of a suggestion to buy or subscribe for any funding.

AOTH/Richard Mills has primarily based this doc on info obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no accountability or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to vary with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any info supplied inside this Report and won’t be held accountable for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or injury for misplaced revenue, which you’ll incur because of the use and existence of the data supplied inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you might be appearing at your OWN RISK. In no occasion ought to AOTH/Richard Mills accountable for any direct or oblique buying and selling losses attributable to any info contained in AOTH/Richard Mills articles. Data in AOTH/Richard Mills articles is just not a suggestion to promote or a solicitation of a suggestion to purchase any safety. AOTH/Richard Mills is just not suggesting the transacting of any monetary devices.

Our publications usually are not a suggestion to purchase or promote a safety – no info posted on this web site is to be thought of funding recommendation or a suggestion to do something involving finance or cash other than performing your personal due diligence and consulting along with your private registered dealer/monetary advisor.

AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with knowledgeable monetary planner or advisor, and that it is best to conduct a whole and impartial investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd is just not a registered dealer, seller, analyst, or advisor. We maintain no funding licenses and will not promote, provide to promote, or provide to purchase any safety.