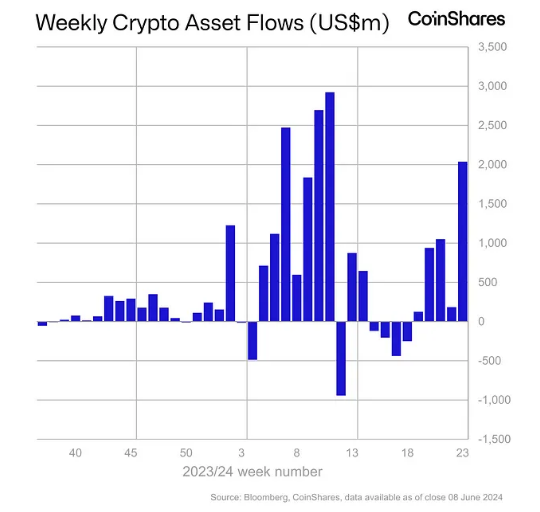

The cryptocurrency market is buzzing with renewed optimism as funding funds witness a historic influx surge. CoinShares, a number one digital asset supervisor, reported a record-breaking $2 billion inflow into crypto funds in only one week, surpassing the complete month of Could’s internet inflows.

This optimistic pattern, now spanning 5 consecutive weeks, has propelled whole belongings underneath administration (AUM) in crypto funds again above the coveted $100 billion mark, a stage final seen in March 2024.

Associated Studying

Bitcoin ETFs Fueling The Fireplace

Bitcoin, the undisputed king of cryptocurrencies, stays the first focus of investor curiosity. The latest launch and sustained inflows into US-approved spot Bitcoin ETFs are a significant driver of the present market sentiment.

These exchange-traded funds, which permit traders to carry Bitcoin with out immediately proudly owning the digital asset, noticed $890 million pour in on June 4th alone, marking their third-largest influx day ever.

This enthusiasm for Bitcoin ETFs suggests a rising urge for food for regulated and accessible methods to take part within the crypto market, probably attracting a broader vary of traders.

Ethereum Shines Vibrant, Altcoins Present Promise

Whereas Bitcoin takes heart stage, Ethereum, the second-largest cryptocurrency, can be having fun with a powerful run. Ethereum funds raked in almost $70 million final week, marking their finest week since March 2024.

CoinShares attributes this optimistic influx to investor anticipation surrounding the upcoming launch of spot Ethereum ETFs within the US. The approval of those ETFs might additional legitimize the Ethereum ecosystem and unlock vital funding potential.

Past the highest two cash, altcoins like Fantom and XRP are additionally experiencing a resurgence in investor curiosity, with inflows of $1.4 million and $1.2 million, respectively. This broader market participation suggests a possible return of investor confidence throughout the crypto panorama.

CoinShares mentioned it noticed that inflows have been unusually widespread throughout almost all suppliers, coupled with a continued discount in outflows from incumbents.

They attribute this shift in sentiment to weaker-than-expected macroeconomic information within the US, which has heightened expectations for an imminent financial coverage fee reduce.

Complete crypto market cap at $2.4 trillion on the every day chart: TradingView.com

Crypto Value Stagnation, Financial Uncertainty

Regardless of the surge in fund inflows, cryptocurrency costs haven’t exhibited a corresponding vital upward motion. This disconnect could possibly be attributed to a number of elements, together with lingering investor uncertainty surrounding the way forward for US financial coverage.

Associated Studying

The present pattern of report inflows into crypto funds paints a optimistic image for the way forward for the market. The rising recognition of regulated funding autos like spot Bitcoin ETFs signifies rising institutional acceptance and probably wider investor adoption.

Featured picture from Vecteezy, chart from TradingView