Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin’s worth has prolonged its weekly drop to six.7%, amid Trump’s threats of a 100% tariff on Canadian imports, as stress pushed BTC under the important thing $89,000 degree.

BTC is down 1% over the past 24 hours, buying and selling at $88,858 as of 12:34 a.m. EST, with buying and selling quantity down 58% to $17.1 billion, in keeping with Coingecko information. The drop in buying and selling quantity signifies decreased exercise, which helps the present bearish sentiment.

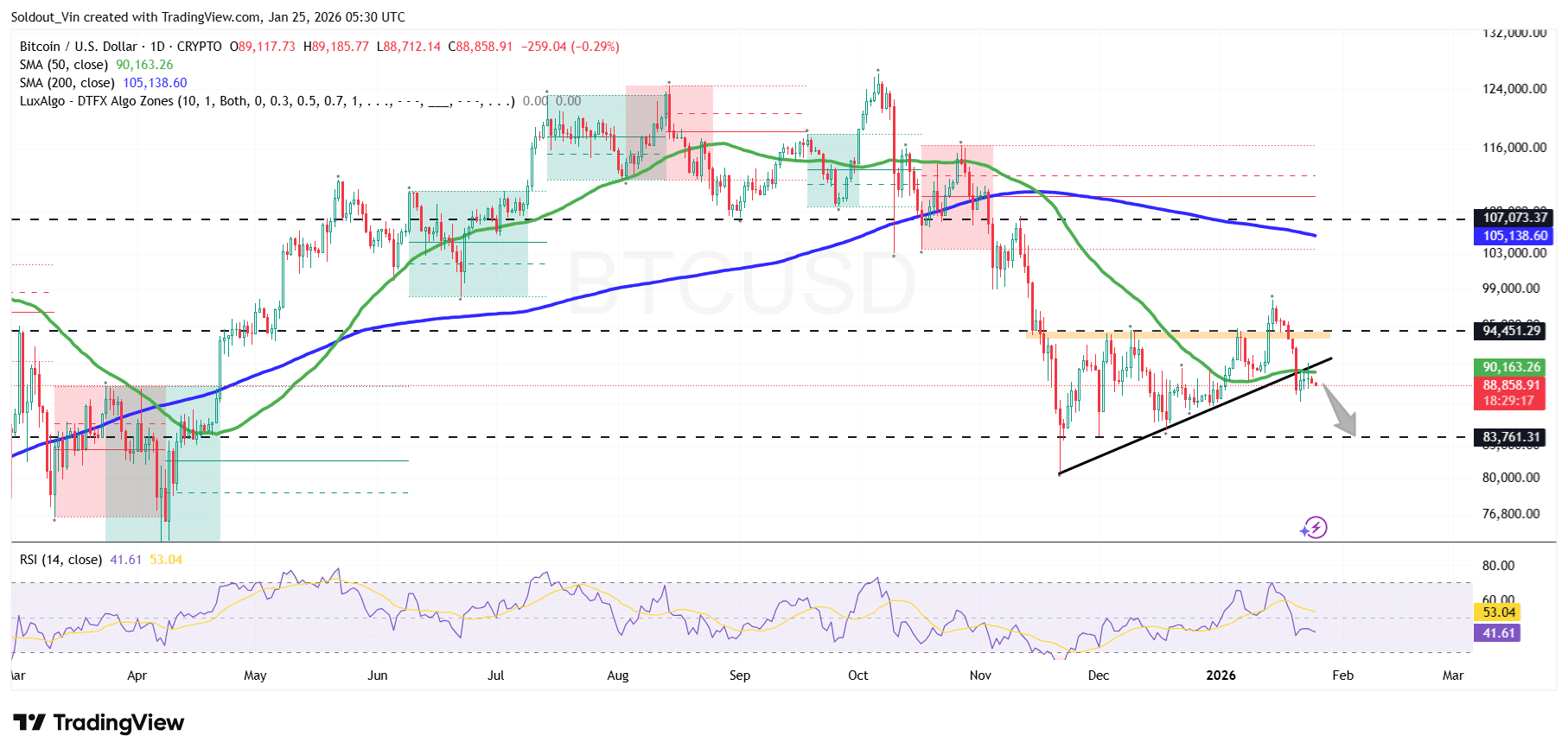

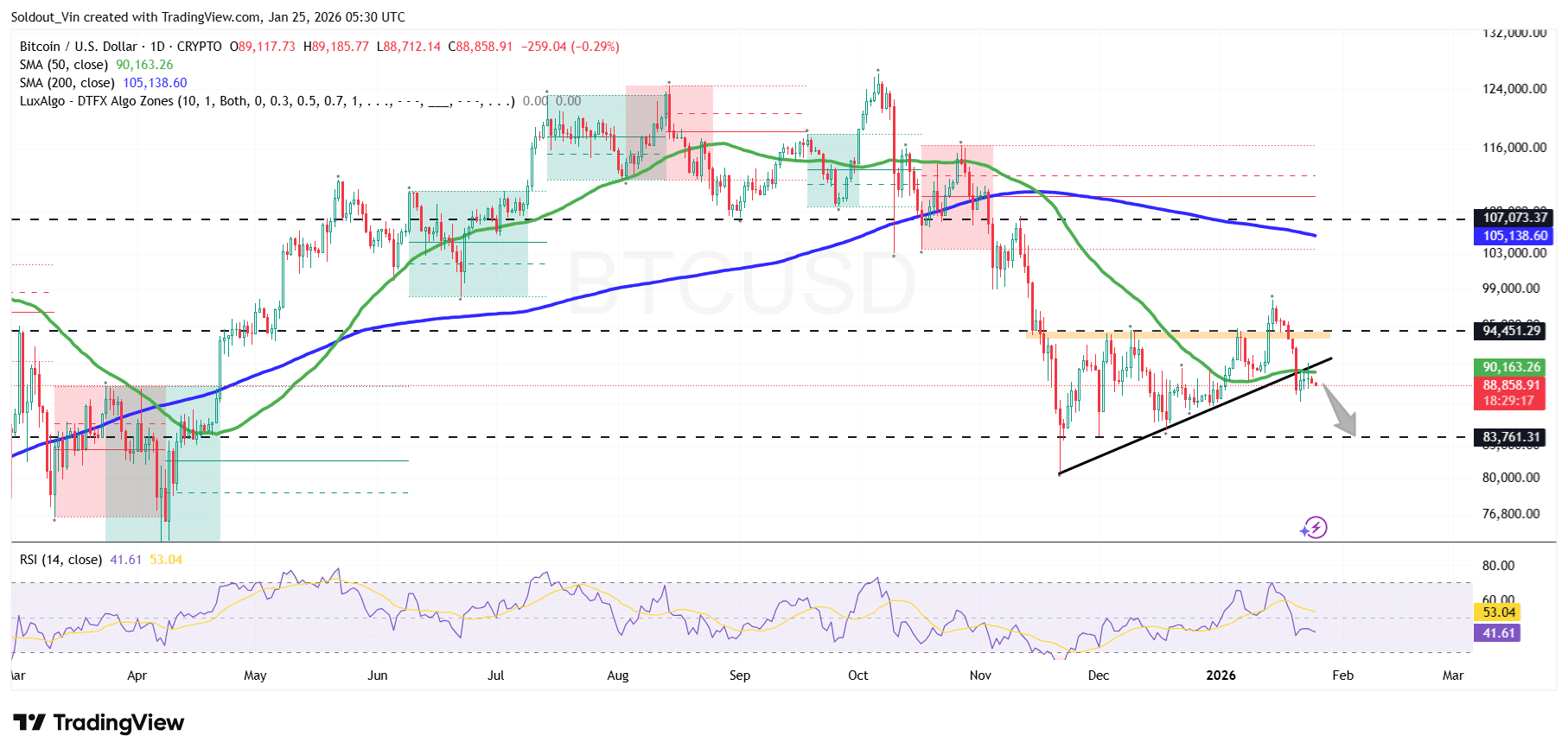

After BTC dropped under the ascending triangle sample, promoting stress has picked up, signaling that sellers are nonetheless answerable for the $90,000 space, which was the earlier help, following a sustained drop from the $97,000-$98,000 degree.

Trump Threatens Canada With 100% Tariff Over Pending Commerce Deal With China

US President Donald Trump stated on Saturday that he would impose a 100% tariff on Canada if it goes by way of with a commerce take care of China and warned Canadian Prime Minister Mark Carney that such a deal would endanger his nation.

“China will eat Canada alive, fully devour it, together with the destruction of their companies, social cloth, and normal lifestyle,” Trump wrote on Reality Social. “If Canada makes a take care of China, it would instantly be hit with a 100% Tariff towards all Canadian items and merchandise coming into the united statesA.”

🚨 BREAKING: President Trump threatens Canada “Governor” Mark Carney with a 100% PERCENT TARIFF if he finalizes a take care of China

CLASSIC TRUMP FAFO 🔥🔥

“If Governor Carney thinks he’s going to make Canada a “Drop Off Port” for China to ship items and merchandise into the United… pic.twitter.com/QZckjKPSj9

— Eric Daugherty (@EricLDaugh) January 24, 2026

Carney had traveled to China this month to reset the nations’ strained relationship and reached a commerce take care of Canada’s second-biggest buying and selling accomplice after the US.

The Chinese language embassy in Canada stated that China was able to work with Canada to implement the necessary consensus reached by the leaders of the 2 nations.

US-Canada tensions have grown in current days following Carney’s criticism of Trump’s pursuit of Greenland.

Trump is now suggesting that China would attempt to use Canada to evade US tariffs.

The continual menace of Trump imposing tariffs has stored markets jittery this month, even after they surged firstly of the 12 months.

US Bitcoin ETFs On A 5-Day Outflow Streak

Because the BTC worth continues to drop, US-based Bitcoin exchange-traded funds have prolonged their outflow streak to 5 days.

Spot BTC ETFs posted $103.5 million in web outflows on Friday, persevering with an outflow streak that started the earlier Friday.

Because of this, complete outflows reached roughly $1.72 billion, together with the shortened four-day buying and selling week within the US on account of Martin Luther King Jr. Day on Monday, in keeping with Farside information.

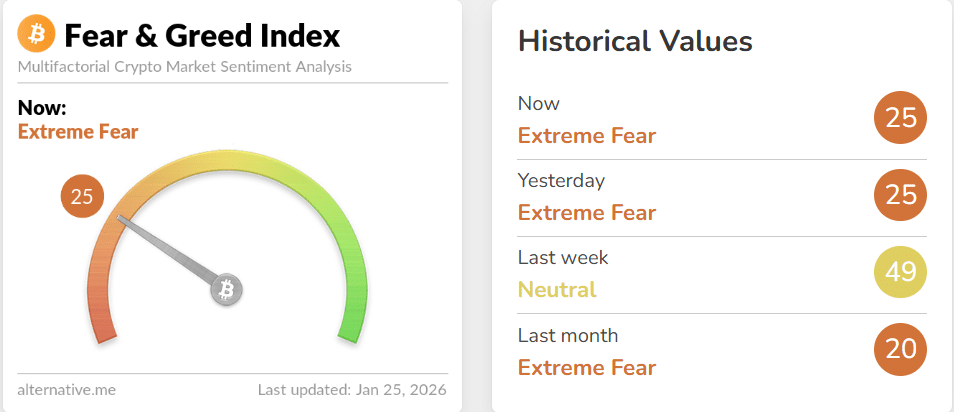

The outflows come because the Crypto Concern and Greed Index, which measures the general crypto sentiment, posted an “Excessive Concern” rating in its replace.

Crypto sentiment platform Santiment stated in a report on Saturday that the crypto market is in “a part of uncertainty.”

Will the BTC worth proceed to drop?

Bitcoin Worth Faces Rising Draw back Strain

Bitcoin has struggled to take care of current positive aspects, slipping again towards month-to-month lows after a short aid rally earlier within the week. The short-lived upside transfer failed to draw robust follow-through, which exhibits continued weak spot within the BTC market.

From a technical perspective, the BTC worth has damaged down under its ascending triangle, a sample that beforehand prompt potential upside continuation.

This drop under the sample indicators a lack of bullish momentum and will increase the danger of additional draw back.

Bitcoin worth is now buying and selling under the 50-day Easy Shifting Common (SMA) ($90,163), which provides to its bearish outlook. This degree had acted as dynamic help in prior weeks however has now flipped into resistance.

The longer-term 200-day SMA at $105,138 stays properly above and continues to cap any significant restoration makes an attempt. This space additionally aligns with a previous provide zone.

Bitcoin worth motion is range-bound, shifting in between roughly $83,500 and $94,400, a sideways construction that has persevered since late November.

Momentum indicators echo this indecision, with the RSI hovering close to 43, suggesting weak shopping for energy however not but oversold situations.

If Bitcoin fails to reclaim $90,000, a transfer towards the $85,000 demand zone is feasible. A confirmed breakdown under that space may expose the $83,500 help degree as the subsequent key draw back goal for BTC.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection