Este artículo también está disponible en español.

Ethereum (ETH) has plummeted 11.4% up to now 24 hours, reflecting a broader market downturn that noticed Bitcoin (BTC) drop by 8%, XRP by 13.6%, and Solana (SOL) by 12.9%. Regardless of the ocean of pink, a number of main voices—together with CryptoQuant CEO Ki Younger Ju—are calling for a extra optimistic perspective on ETH.

Time To Go Bullish On Ethereum

Sharing his “bullish ideas on ETH” through X, Ki Younger Ju argued there was “no vital promote strain” regardless of the current Bybit hack, declaring that each on-chain and market information stay impartial. “Trade promoting takes time, and OTC offloads barely have an effect on the value,” he added.

He additionally emphasised Ethereum’s dominant share of the stablecoin market cap—at the moment round 56% and famous how potential regulatory shifts below the Trump administration, which is reportedly “easing crypto regs,” might spur additional adoption of ETH-based stablecoins and sensible contracts in 2025.

Associated Studying

Ju referenced further catalysts, reminding followers that the ETH spot ETF “is already authorised,” suggesting {that a} “Massive Cap ETF altseason” could be on the horizon for Ethereum. He added, “BlackRock ETH spot ETF holdings elevated 124% over the previous three months.”

Lastly, Ju highlighted rising whale accumulation: addresses holding 10,000 to 100,000 ETH have elevated their balances by 24% over the previous yr, with the present worth “nearing the associated fee foundation of accumulating addresses.”

Nevertheless, Ju admitted he was “stunned” by what he sees as an overwhelmingly bearish temper on Crypto Twitter.

“Wow, CT [Crypto Twitter] sentiment on ETH is extraordinarily bearish. Let me know when you’ve got any data-driven evaluation to assist your bearish thesis. Most bears appear to quote the dropping worth itself as their motive for promoting. Very attention-grabbing,” Ju remarked.

On his various X account—below the deal with @kate_young_ju—he reiterated that “whales are stacking ETH,” pointing to the present value foundation for these accumulating addresses at round $2,199, in comparison with the spot worth hovering close to $2,505.

Ju shouldn’t be alone in difficult the doom-and-gloom market narrative. AdrianoFeria.eth (@AdrianoFeria), an member of the ETH neighborhood, asserted that “the market is within the shitter” however urged traders to concentrate on high-level institutional and political alerts favoring Ethereum.

Associated Studying

He particularly cited experiences of the US President and household buying “a whole lot of thousands and thousands of {dollars} price of ETH,” the CEO of BlackRock’s endorsement of tokenization (and BlackRock’s personal tokenized USD experiment on Ethereum), and Bybit’s want to purchase massive portions of ETH to cowl its hack—probably fueling extra demand.

Feria additionally talked about that Ken Griffin, the CEO of Citadel believes Ethereum might change Bitcoin. For this neighborhood member, the truth that “everybody on CT remains to be taking a shit on ETH” solely reinforces a contrarian bullish stance.

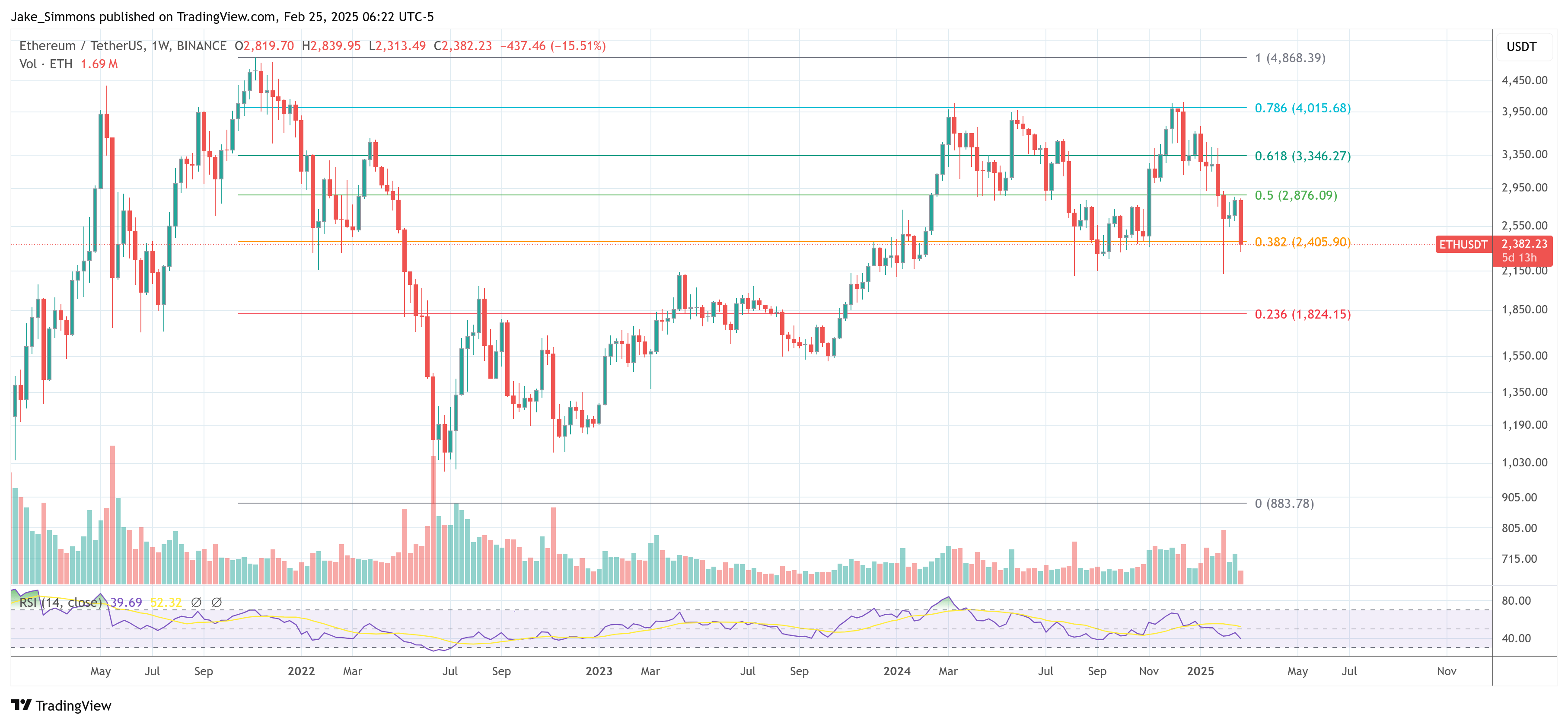

Widespread crypto analyst IncomeSharks (@IncomeSharks) weighed in by posting a chart displaying one other “pink scary candle” however indicating a purchase zone above $2,400.

In the meantime, Chris Burniske, associate at Placeholder VC, provided historic perspective, reminding followers of 2021’s mid-cycle drawdowns: BTC fell 56%, ETH 61%, SOL 67%, and plenty of different property 70-80%. In accordance with Burniske, “you may provide you with all the explanations for why this cycle is completely different, however the mid-bull reset we’re going by way of isn’t unprecedented. These calling for a full blown bear are misguided.”

At press time, ETH traded at $2.382.

Featured picture created with DALL.E, chart from TradingView.com