Be a part of Our Telegram channel to remain updated on breaking information protection

Solana (SOL) is holding agency above the $127 stage after every week of consolidation, even because the broader crypto market faces lingering bearish stress.

Whereas SOL has skilled regular promoting, it continues to draw robust institutional curiosity, setting it aside from many main property. On the identical time, the broader market is displaying early indicators of stabilization, with Bitcoin hovering close to $89,000 and Ethereum buying and selling round $2,950.

Regardless of this tentative restoration, uncertainty stays elevated because the U.S. Senate quickly suspends periods to evaluate and mark up a crypto-related invoice, leaving regulatory readability unresolved within the brief time period. A key bullish sign for Solana is the surge in ETF inflows. Over the previous week, Solana-focused exchange-traded funds recorded greater than $11 million in web inflows, outperforming each Bitcoin and Ethereum ETFs throughout the identical interval.

🚨BREAKING: SOLANA ETF INFLOWS OUTPERFORM ETHEREUM AND BITCOIN!!!🚨 pic.twitter.com/JoFpDl2N2u

— SolanaNews.sol (@solananew) January 23, 2026

Main institutional gamers, together with Constancy, Grayscale, and Bitwise, have pushed this demand. Constancy’s Solana ETF (FSOL) led the cost with a single-day influx of $9.85 million, pushing its cumulative inflows to roughly $148 million. In whole, Solana ETFs now handle round $1.08 billion in web property, giving SOL a 1.50% web asset ratio inside these merchandise.

In distinction, Bitcoin ETFs noticed outflows of about $38.5 million, whereas Ethereum ETFs declined by roughly $64.9 million, highlighting a transparent shift in institutional choice towards Solana. Past ETFs, Solana can be gaining momentum on the on-chain exercise entrance. Current information exhibits Solana main all blockchains in decentralized alternate (DEX) quantity, recording roughly $4.4 billion in trades over 24 hours.

This determine considerably outpaced competing networks, underscoring rising person adoption and liquidity on the Solana ecosystem. With buying and selling exercise surpassing rivals like Binance Good Chain and Ethereum, analysts see this as a robust indicator of Solana’s increasing position in decentralized finance and its potential for continued progress, even amid broader market uncertainty.

Solana Worth Consolidates Close to $127 Signaling Potential Reversal

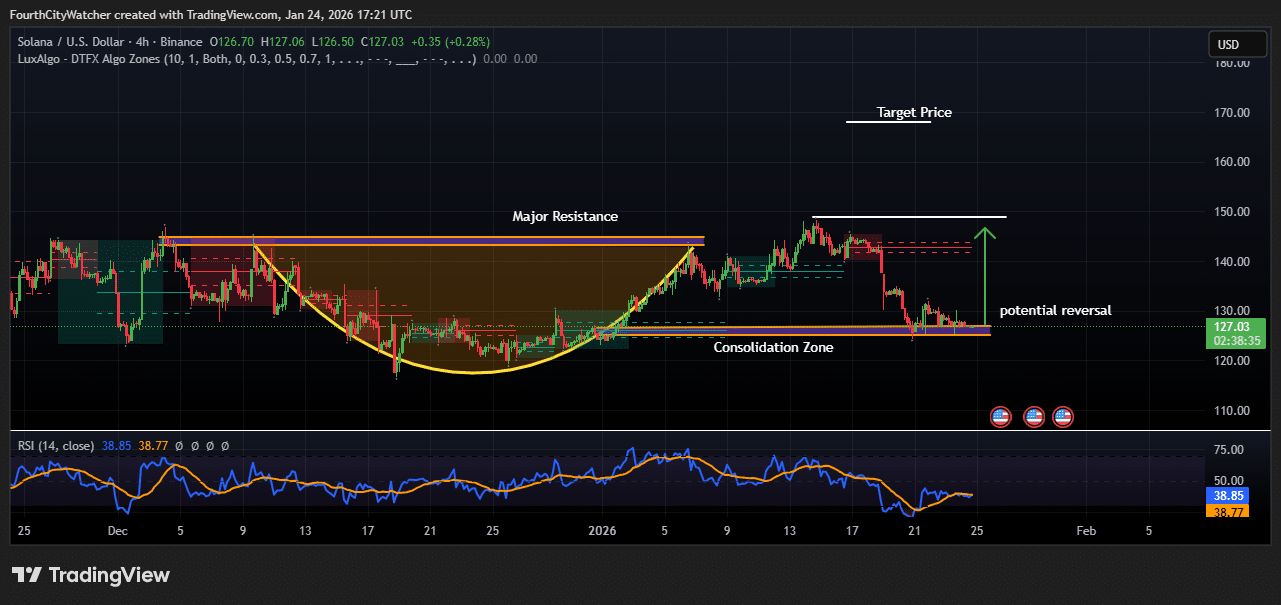

Solana Worth buying and selling pair steadily trades on the $127 stage after experiencing a pointy pullback from latest highs. Regardless of ongoing weak point within the broader crypto market, SOL has managed to carry above a key assist zone, signaling short-term stability. The value motion exhibits that sellers have slowed down close to the $125–$127 space, permitting Solana to maneuver sideways moderately than proceed falling. This consolidation means that the market could also be getting ready for its subsequent directional transfer.

Earlier, Solana confronted robust rejection close to the $145–$150 resistance vary, the place promoting stress elevated and pushed the value decrease. That zone stays a serious barrier for any upside restoration. For the reason that rejection, SOL has returned to a traditionally necessary demand space, the place consumers have beforehand stepped in. The truth that this stage is holding provides confidence that the draw back could also be restricted for now.

SOLUSD Chart Evaluation. Supply: Tradingview

The Relative Power Index (RSI) on the 4-hour timeframe is hovering round 38–39, which locations SOL near oversold situations. Whereas the RSI has not but produced a transparent bullish sign, its flattening motion signifies that bearish momentum is weakening. In comparable previous conditions, any such RSI habits close to robust assist has usually led to short-term reduction rallies.

If consumers proceed to defend the present consolidation zone, Solana may try a rebound towards the $140 stage. A break above that space would enhance the bullish outlook and open the door for a retest of the $145–$150 resistance vary. Such a transfer would probably require stronger market sentiment and elevated shopping for quantity.

Nonetheless, dangers stay on the draw back. A decisive transfer under the $125 assist would invalidate the consolidation construction and expose Solana to additional declines towards the $120 psychological stage. Till a transparent breakout or breakdown happens, SOL is anticipated to stay range-bound, with merchants intently awaiting affirmation of both a reversal or continued weak point.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection