Be part of Our Telegram channel to remain updated on breaking information protection

Solana value dropped beneath an important help stage round $123 on Monday morning, as BTC and most altcoins confronted rejection. SOL plummeted to an intraday low of round $117.75, because it confronted a hurdle inside the $126.84 stage, based on Coingecko information.

This stage marks its lowest since December 2025, and is over 58% beneath the September excessive of $253.

SOL is down 3.7% during the last 24 hours, buying and selling at $122.16 as of 05:24 a.m. EST. Nevertheless, buying and selling quantity has skyrocketed by 319% to $6.7 billion, an indication that buying and selling exercise is rising.

The drop within the value comes whilst Solana’s weekly stablecoin inflows clocked in over $1.3 billion.

Solana Attracts $1.3B in Stablecoin Inflows

Solana has recorded the biggest stablecoin inflows throughout all blockchains during the last week, including round $1.3 billion in new stablecoin provide, based on information from Artemis.

Such a pattern indicators rising capital flows into Solana and a shift towards the blockchain for quicker, extra energetic transactions. Subsequently, liquidity continues to construct on its DeFi ecosystem.

Based mostly on the info, the Ethereum ecosystem has skilled an outflow of round $3.4 billion from the stablecoin provide, marking one of many largest weekly outflows in current months and highlighting a change in consumer habits.

The shift from different blockchains to Solana will be attributed to its decrease charges and better throughput in comparison with Ethereum, usually described as the costliest blockchain within the crypto area.

Because the SOL value remained on edge, fundamentals nonetheless remained robust forward of the upcoming Alpenglow improve in February or March.

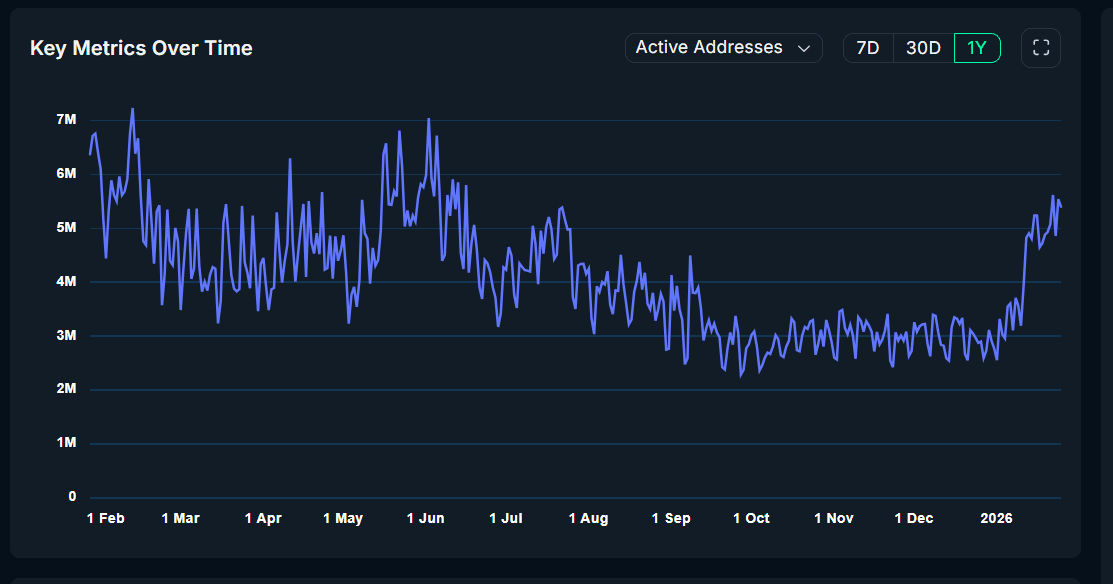

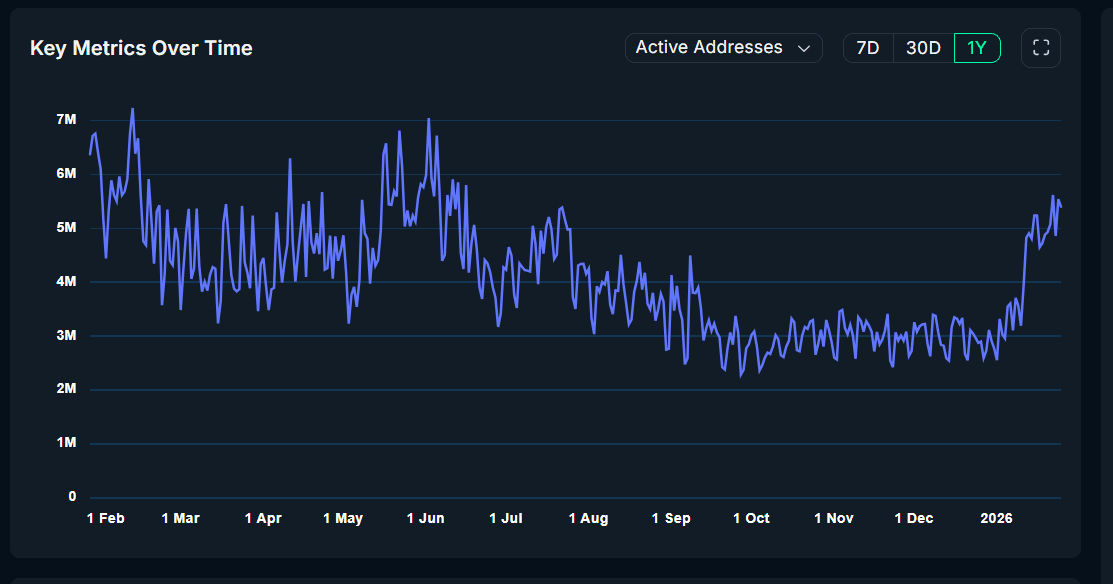

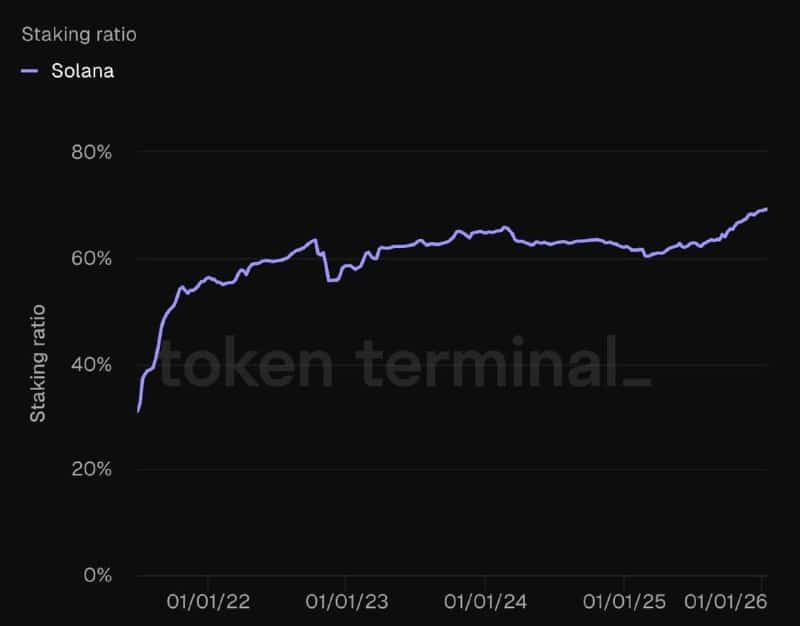

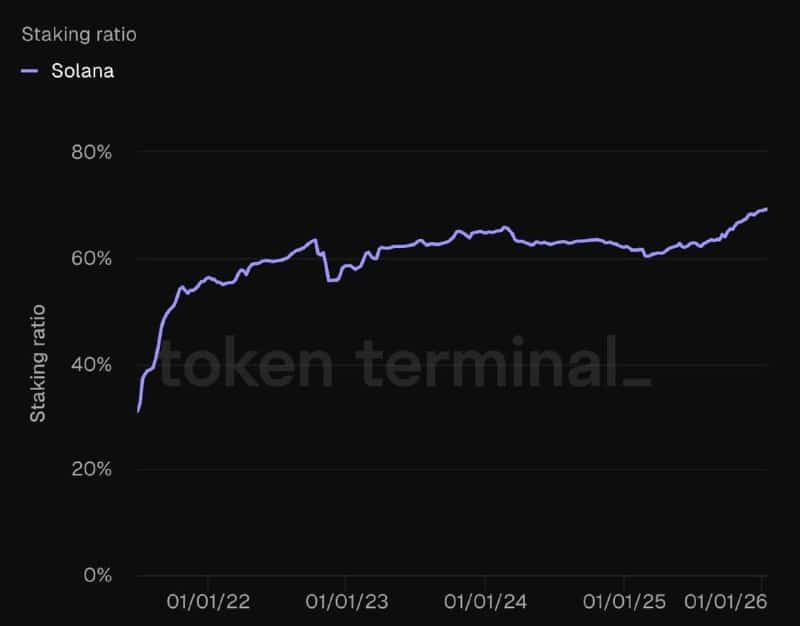

Solana’s metrics are leaping and are much better than these of different blockchains, based on Naansen information.

In the meantime, staking exercise surged to an all-time excessive of 70%, with over $60 billion value of SOL staked. This exhibits robust conviction from long-term holders, signaling that buyers had been dedicated to the community’s future.

With fundamentals turning constructive, can Solana’s value get better from its 9% weekly drop?

Solana Value Nonetheless Beneath Bearish Strain

Solana value is at the moment retracing into the $120 demand zone, an space that has beforehand acted as a weekly consolidation base.

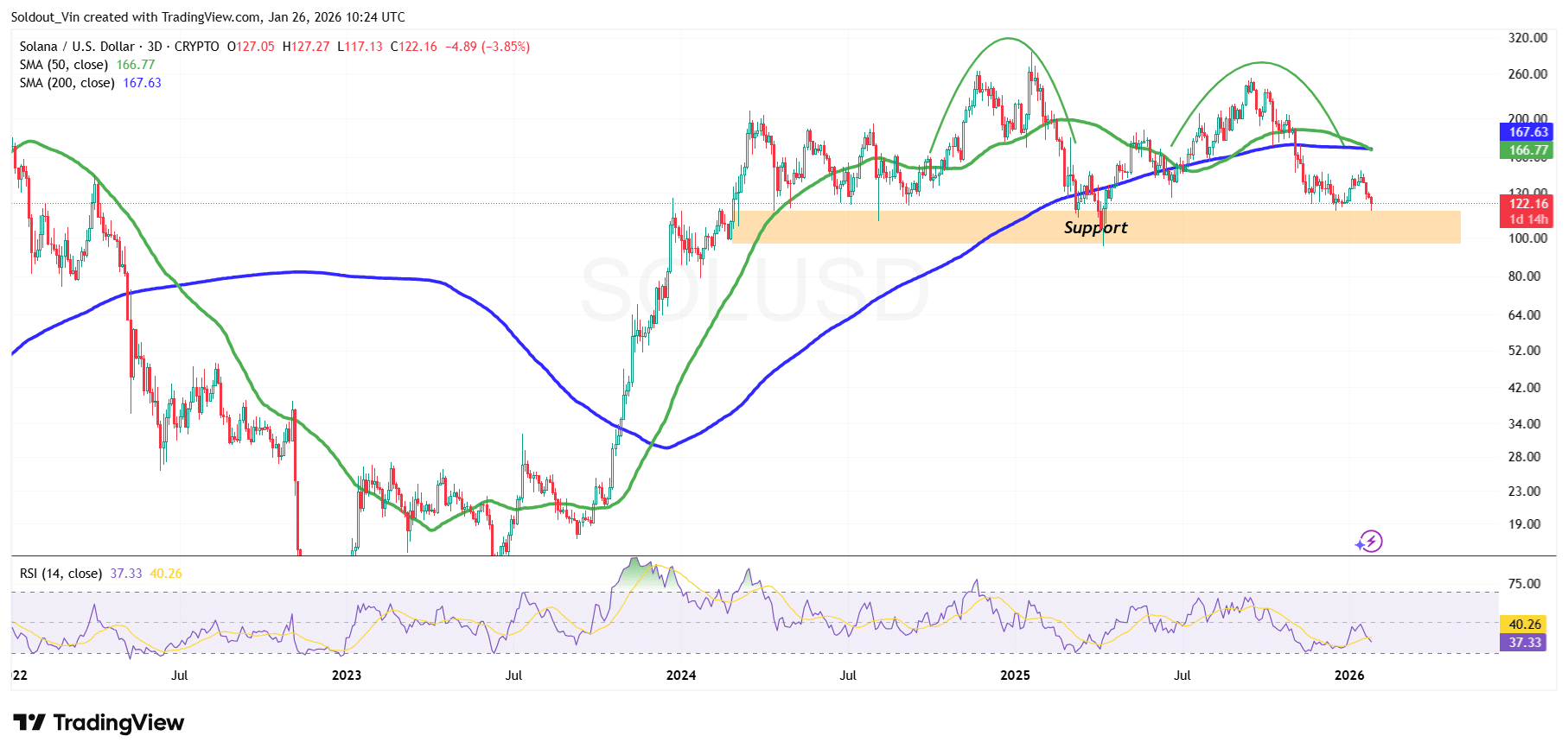

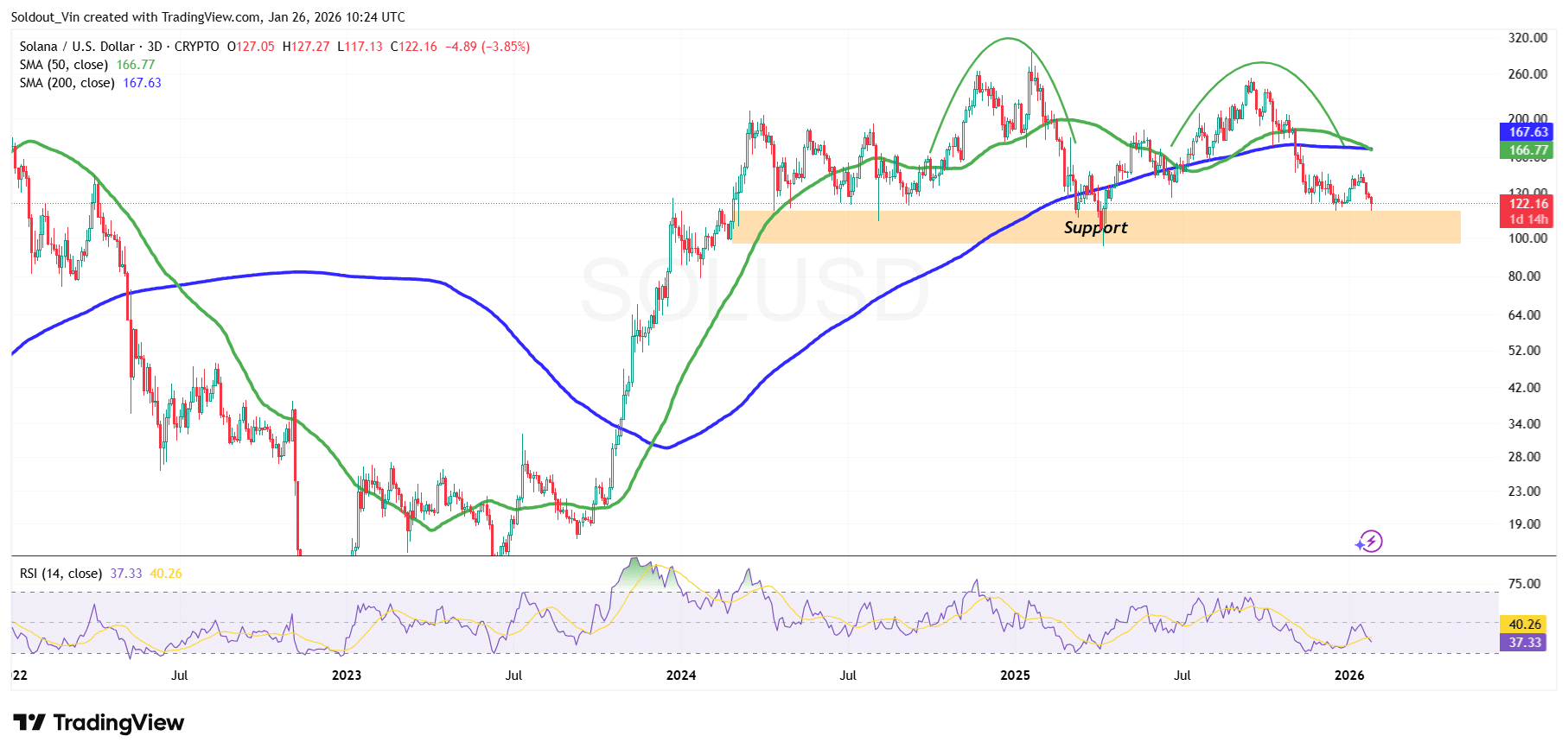

SOL stays beneath each the 50-day and 200-day Easy Transferring Averages (SMAs) on the weekly chart, indicating the value remains to be beneath bearish stress.

Current value habits exhibits SOL shifting sideways inside a broader vary, with consumers constantly stepping in across the $120–$130 area. This repeated protection suggests longer-term market contributors proceed to build up, whilst shorter-term merchants cut back publicity.

The bearish stress has been pushed by SOL’s value forming a double high sample, which might sign an extra decline.

In the meantime, the 50-day SMA has crossed beneath the 200-day SMA, forming a loss of life cross across the $167 stage amid the current drop from above the $130 space.

Momentum indicators help this view. The weekly RSI is at the moment at 37.33, following a current drop that implies sellers are nonetheless in management.

SOL is again buying and selling inside the $110-$125 help space, which has not too long ago held the value since its dramatic rally again in 2023.

The loss of life cross and falling RSI point out the value is liable to an extra decline. If this occurs, the value of SOL might hold dropping, risking a sustained plunge to the $110 help space within the coming days.

Conversely, the rising fundamentals might sign a restoration. In such a state of affairs, the Solana token would wish to reclaim the 50-day SMA round $166. If this occurs, the value of Solana might surge again to the $179 space, which has beforehand acted as help and is now performing as resistance.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection