Diversified drubbing

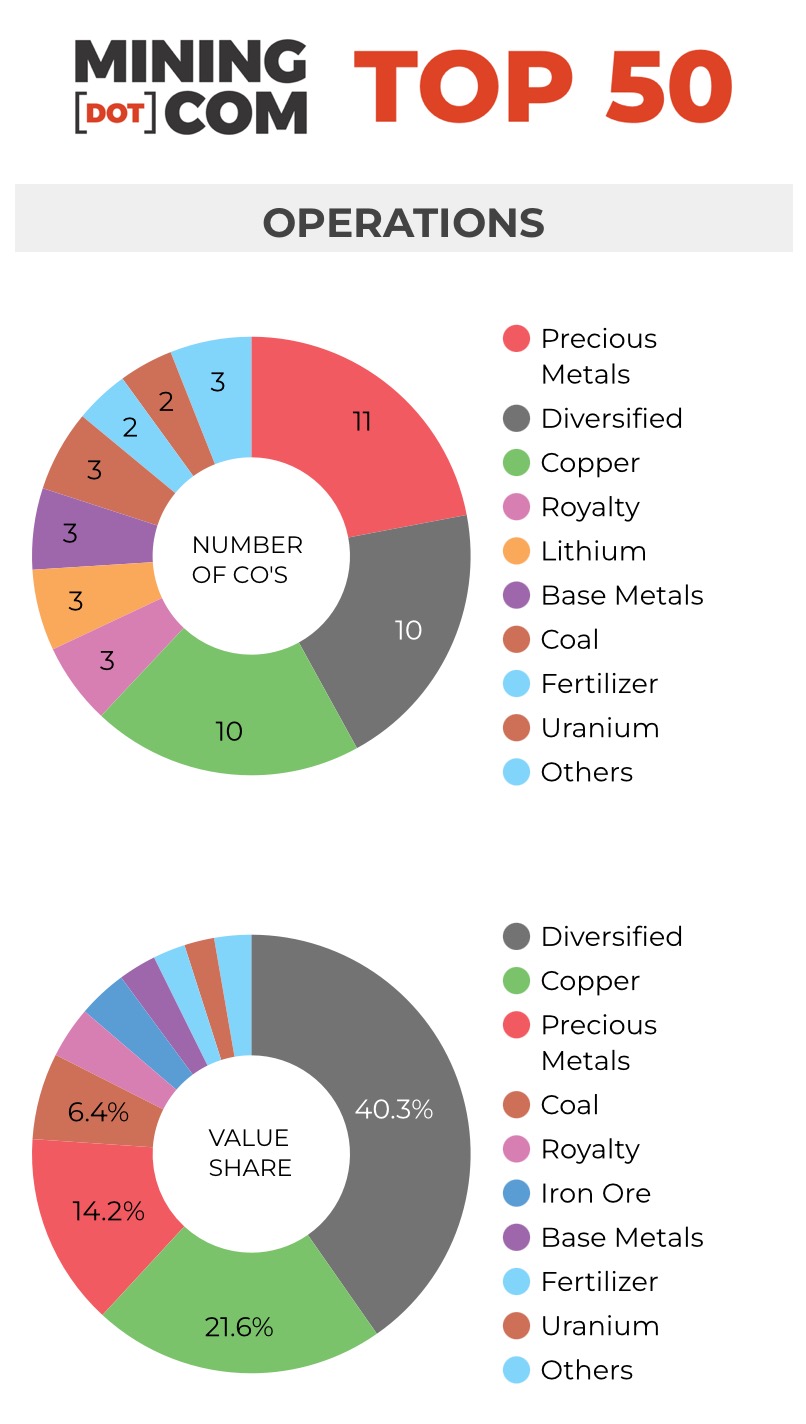

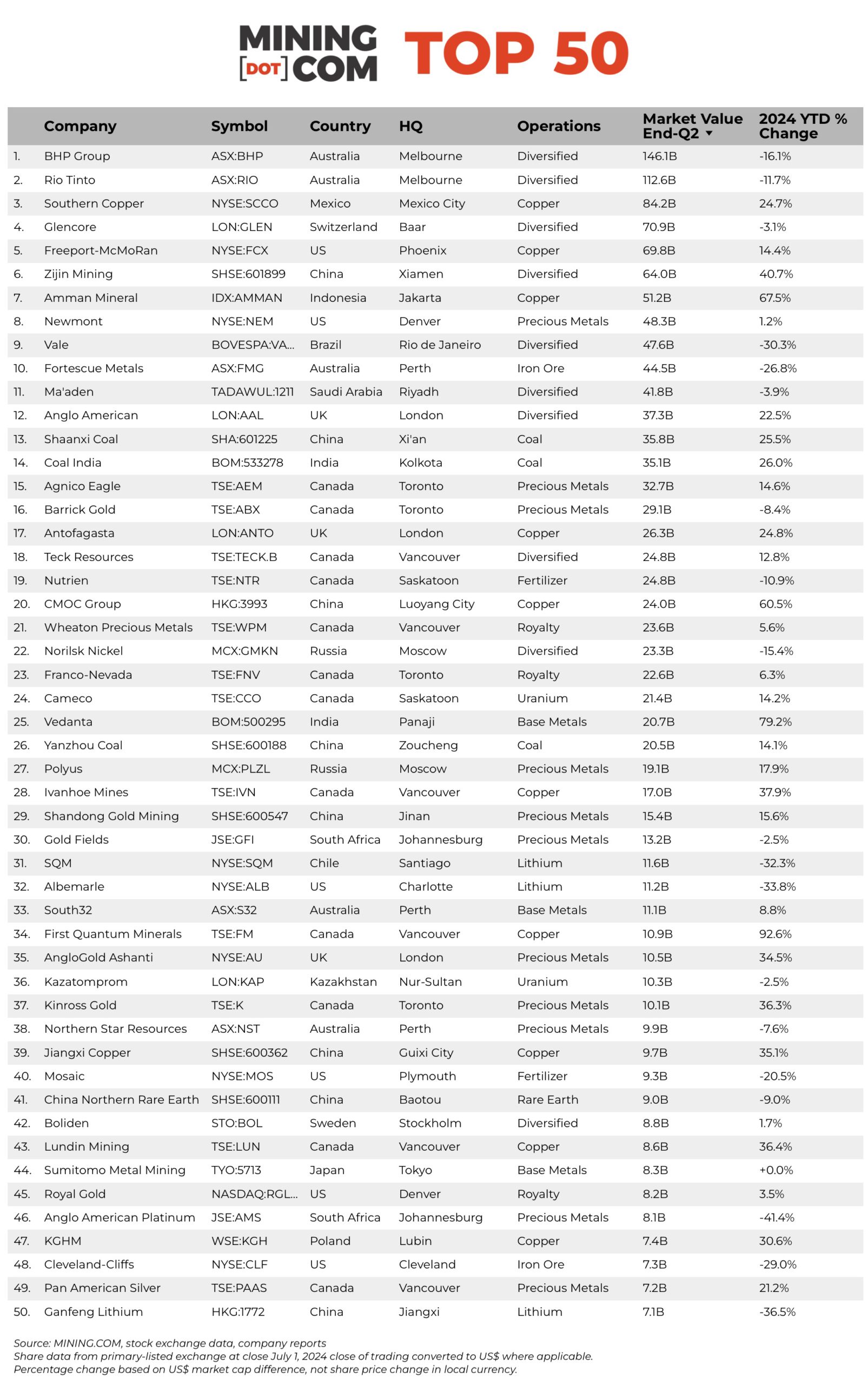

Copper specialists have gained a mixed 33% 12 months so far however the trade’s conventional large 5 – BHP, Rio Tinto, Glencore, Vale and Anglo American – have misplaced a collective $59 billion because the begin of the 12 months.

The enhance from copper was additionally not sufficient to counter iron ore’s descent into bear territory from dragging down the group which now make up 29% of the entire index, down from a peak of 38% on the finish of 2022. The steelmaking ingredient’s lower than rosy outlook additionally sees two specialists – Cleveland Cliffs and Fortescue – seem within the worst performer record.

Had been it not for Glencore’s lack of publicity to iron ore aside from by way of buying and selling steadying the Swiss big’s share value, and Anglo American’s 25% soar in the course of the quarter on the again of BHP’s unsuccessful takeover bid, mining’s conventional heavyweights could be an much more diminished grouping.

Traders in Anglo, with a historical past going again greater than 100 years on the South African gold and diamond fields, have had a very wild experience over the previous couple of years. In January 2016, Anglo’s market cap fell under $5 billion and even after the inventory’s Q2 bump, remains to be solely value half its peak valuation hit in 2022.

Whereas the BHP takeover is unlikely to be revived, M&A among the many high of the mining trade appears inevitable, significantly when copper is concerned, given the billions of {dollars} of capital expenditure wanted for enlargement and simply to maintain working mines ticking over, to satisfy demand for the steel by way of the subsequent decade.

Mild on lithium

Three counters dropped out of the highest 50 in the course of the first quarter. Brazil’s CSN Mineração, an iron ore miner, China’s Huayou Cobalt and Australian lithium producer Pilbara Minerals.

On the finish of Q2, two extra lithium shares – Perth-based Mineral Assets and China’s Tianqi Lithium – exited the highest 50 because the deep droop in costs for the battery steel continues to take its toll.

Mineral Assets was solely simply pipped by Ganfeng Lithium and primarily based on its efficiency to date in July, the Australian arduous rock lithium miner might effectively return to the fold.

Ganfeng was barely holding on at place 50 at end-June and with gold value momentum persevering with and two gold mining firms ready within the winds – Yintai and Alamos – solely three lithium counters within the high 50 could also be a actuality for a while to return.

After peaking within the second quarter of 2022 with a mixed worth of almost $120 billion, the remaining lithium shares’ market worth now barely exceeds $30 billion.

Can’t high copper

Copper, gold producers and royalty firms made up 40% of the index on the finish of Q2 on par with diversified miners as Pan American Silver following its absorption of Yamana Gold enters the rating for the primary time and Polish copper big KGM returns after including 17% to its market cap in the course of the quarter.

Talks of a attainable reopening of its Panama mine noticed First Quantum Minerals’ market valuation almost doubling in US greenback phrases from its low on the finish of final 12 months, and the Vancouver-based firm is now firmly again within the rating at #34 after dropping out on the finish of final 12 months.

Amman Mineral continues its run up, piercing the highest 10 for the primary time after gaining 67% 12 months so far, and 580% since its debut in Jakarta a 12 months in the past, lifting the copper-gold firm’s market cap to over $50 billion.

Amman’s Batu Hijau is the third largest mine worldwide by way of copper equal output and has been in manufacturing because the flip of the millennium. Amman can be creating the adjoining Elang undertaking on the island of Sumbawa.

Radiant uranium

Whereas spot uranium costs have retreated again under the triple digit costs hit in January, the mixed market cap of the sector remains to be up 42% from final 12 months this time and collectively now surpasses that of the lithium counters within the rating.

The world’s largest uranium producers – Cameco and Kazatomprom – solely made the highest 50 in 2021 with the Saskatoon-based firm and state-owned Kazakh producer spending years within the wilderness put up the Fukushima catastrophe in Japan.

Not one of the smaller uranium firms led by Canada’s Nexgen Power, valued at a shade over $4 billion, is prone to make it into the highest 50 by themselves, however mixtures among the many rank and file could be within the offing as curiosity within the sector and mining M&A typically grows.

Kazatomprom dual-listed in London and Astana in 2018 and Uzbekistan is readying an IPO for Navoi Mining and Metallurgy Combinat – the world’s fourth largest gold mining firm and important uranium producer later this 12 months.

Navoi would be part of the ranks of gold producers within the high 50 because of possession of the world’s largest gold mine, Muruntau, and annual manufacturing of two.9 million ounces at grades the envy of the sector. Navoi may also carry to 5 the variety of firms with publicity to the nuclear gasoline within the rating.

Notes:

Supply: MINING.COM, inventory trade information, firm reviews. Share information from primary-listed trade at shut July 1, 2024 shut of buying and selling transformed to US$ the place relevant. Share change primarily based on US$ market cap distinction, not share value change in native foreign money.

As with every rating, standards for inclusion are contentious. We determined to exclude unlisted and state-owned enterprises on the outset as a result of a lack of understanding. That, in fact, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining (the gold and uranium big might record later this 12 months), Eurochem, a significant potash agency, and various entities in China and creating international locations world wide.

One other central criterion was the depth of involvement within the trade earlier than an enterprise can rightfully be known as a mining firm.

As an illustration, ought to smelter firms or commodity merchants that personal minority stakes in mining belongings be included, particularly if these investments haven’t any operational element or warrant a seat on the board?

It is a frequent construction in Asia and excluding most of these firms eliminated well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Ranges of operational or strategic involvement and dimension of shareholding had been different central concerns. Do streaming and royalty firms that obtain metals from mining operations with out shareholding qualify or are they only specialised financing automobiles? We included Franco Nevada, Royal Gold and Wheaton Valuable Metals on the idea of their deep involvement within the trade.

Vertically built-in issues like Alcoa and vitality firms comparable to Shenhua Power or Bayan Assets the place energy, ports and railways make up a big portion of revenues pose an issue. The income combine additionally tends to alter alongside unstable coal costs. Identical goes for battery makers like China’s CATL which is more and more transferring upstream, however the place mining will proceed to signify a small portion of its valuation.

One other consideration is diversified firms comparable to Anglo American with individually listed majority-owned subsidiaries. We’ve included Angloplat within the rating however excluded Kumba Iron Ore during which Anglo has a 70% stake to keep away from double counting. Equally we excluded Hindustan Zinc which is listed individually however majority owned by Vedanta.

Many steelmakers personal and infrequently function iron ore and different steel mines, however within the curiosity of steadiness and variety we excluded the metal trade, and with that many firms which have substantial mining belongings together with giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and plenty of others.

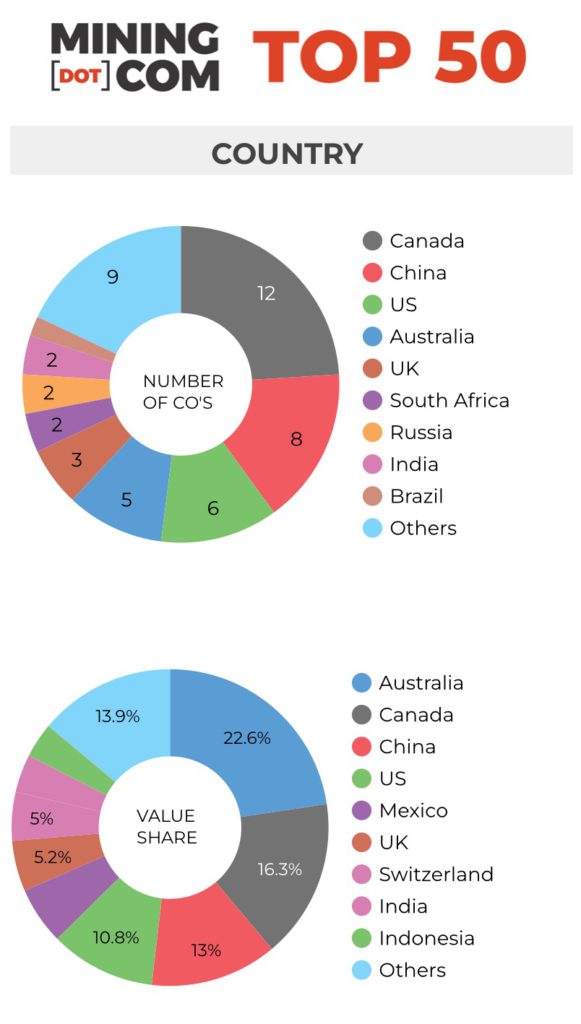

Head workplace refers to operational headquarters wherever relevant, for instance BHP and Rio Tinto are proven as Melbourne, Australia, however Antofagasta is the exception that proves the rule. We think about the corporate’s HQ to be in London, the place it has been listed because the late 1800s.

Please tell us of any errors, omissions, deletions or additions to the rating or counsel a unique methodology.