Be a part of Our Telegram channel to remain updated on breaking information protection

Technique, the Bitcoin treasury agency led by Michael Saylor, has purchased a further $217.4 million value of BTC.

In response to a Sept. 8 8-Ok submitting with the US Securities and Trade Fee (SEC), the corporate purchased 638,460 BTC between Sept. 2 and Sept. 7 at a median buy worth of $111,196.

Technique’s newest Bitcoin buy was funded by the proceeds from at-the-market gross sales of its Class A typical inventory, MSTR, perpetual Strike most popular inventory, STRK, and perpetual Strife most popular inventory, STRF.

Relentless Dilution, Underperformance

Saylor stated on X that Technique’s holdings now stand at 638,460 BTC, or 3% of Bitcoin’s 21 million provide, acquired for $47.17 billion. The typical acquisition worth for these cash is round $73,880, he added.

Technique has acquired 1,955 BTC for ~$217.4 million at ~$111,196 per bitcoin and has achieved BTC Yield of 25.8% YTD 2025. As of 9/7/2025, we hodl 638,460 $BTC acquired for ~$47.17 billion at ~$73,880 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/QNIuAWRwEW

— Michael Saylor (@saylor) September 8, 2025

Technique is sitting on an unrealized achieve of $25.76 billion.

Whereas Technique’s latest purchase and big paper features could possibly be seen as positives for the crypto trade, a number of Technique buyers have shared their frustration with the corporate’s continued BTC accumulation.

One X consumer questioned the corporate’s shopping for exercise, asking why their MSTR shares are being diluted “to line Technique’s company pockets.” Different customers replied to the remark and advised the disgruntled investor to concentrate on the quantity of BTC per share they maintain as a substitute of the greenback worth of the shares.

In the meantime, one other X consumer who claims to be a shareholder in Technique stated buyers need to hear Saylor’s ideas on why MSTR is underperforming towards BTC, including that “the dilution is relentless.”

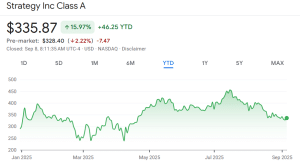

MSTR has recorded a achieve of barely lower than 16% during the last yr, in response to Google Finance, whereas Bitcoin has soared over 105% throughout the identical interval.

MSTR YTD efficiency (Supply: Google Finance)

BTC slid round 4% in comparison with a 15% slide for MSTR.

Saylor stated Technique has achieved a year-to-date (YTD) achieve of 25.8% on its Bitcoin holdings, however consumer Boris Sixson on X stated that he stays disenchanted.

“Sure, you made a revenue…We, as buyers in $MSTR inventory, made a loss,” he stated “What a phenomenal world. You get richer. You progress up within the rating of the wealthy… Allow us to have a look at the rising losses, together with as we speak.”

Including to MSTR buyers’ woes is Technique’s latest snub from the S&P 500 index. Though Technique met the entire necessities for inclusion within the index, it missed out to corporations that included Robinhood (HOOD).

MSTR continues to be listed on the Nasdaq, however Bloomberg estimated that inclusion within the S&P 500 might have led to inflows for MSTR of $16 billion as funds that observe it might have been compelled to purchase up Technique shares.

Metaplanet And El Salvador Purchase BTC As Sentiment Improves

Technique isn’t the one firm that has purchased Bitcoin as we speak. Japan-based Metaplanet introduced earlier as we speak that it purchased 136 BTC, pushing its whole holdings to twenty,136 BTC value greater than $2.2 billion.

*Metaplanet Acquires Extra 136 $BTC, Whole Holdings Attain 20,136 BTC* pic.twitter.com/c41t6bJg1L

— Metaplanet Inc. (@Metaplanet_JP) September 8, 2025

And El Salvador additionally added to its BTC hoard. President Nayib Bukele introduced on X yesterday that El Salvador bought 21 Bitcoins to have a good time the fourth anniversary of its Bitcoin Legislation.

The nation now holds 6,313.18 BTC valued at round $701 million, in response to the federal government’s blockchain information.

The Bitcoin shopping for from Technique, Metaplanet and El Salvador comes amid enhancing investor sentiment available in the market.

Within the final 24 hours, the Crypto Worry and Greed Index, a well-liked device to gauge investor sentiment, has risen from a “Worry” studying of 44 to a “Impartial” rating of 51. That’s nonetheless down from a “Greed” studying of 67 a month in the past.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection