Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth has surged 4% prior to now 24 hours to commerce at $2,947 as of 4:00 a.m. EST on a 41% surge in buying and selling quantity to $36 billion.

Ethereum worth improve comes as weaker US inflation drives constructive market sentiment, even because the Financial institution of Japan (BOJ) raised rates of interest. The US Shopper Worth Index (CPI) rose 2.7% over 12 months to November, down from 3% in September, shocking analysts and signaling a slowdown in worth pressures.

🚨BREAKING: U.S. CPI got here in beneath expectations at 2.7% vs 3.1% anticipated.

This reveals inflation is cooling down.

FED now has extra room for charge cuts and financial easing.

That is actually bullish for markets. pic.twitter.com/ZWrzqwNBaA

— Bull Principle (@BullTheoryio) December 18, 2025

Falling prices for inns, milk, clothes, and housing, together with vacation reductions, bolstered investor confidence. Meaning softer inflation will increase the probability of US Federal Reserve charge cuts, which fuels optimism in cryptocurrencies like Ethereum and Bitcoin.

Whereas some dangers stay, from earlier tariffs and tight labor provide in sectors similar to farming, hospitality, and building, the market reacted strongly to the cooling CPI, displaying that US financial alerts proceed to have an outsized impression on crypto sentiment.

Don’t combat the BOJ: -ve actual charges is the specific coverage. $JPY to 200, and $BTC to a milly. pic.twitter.com/PdZh87ruVI

— Arthur Hayes (@CryptoHayes) December 19, 2025

Regardless of this, the BOJ raised rates of interest by 25 foundation factors to 0.75%, the best in 30 years, marking its second hike this 12 months. Governor Kazuo Ueda indicated that additional will increase could observe in 2026, though actual charges stay adverse, protecting Japanese monetary circumstances accommodative.

The Yen weakened to round 156 per greenback, reducing the speedy dangers of a carry commerce unwind. Bitcoin confirmed volatility in response to the BOJ hike, with previous charge will increase traditionally triggering 23–31% declines. US 10-year Treasury yields rose to 4.14%, and the greenback index (DXY) reached 98.52.

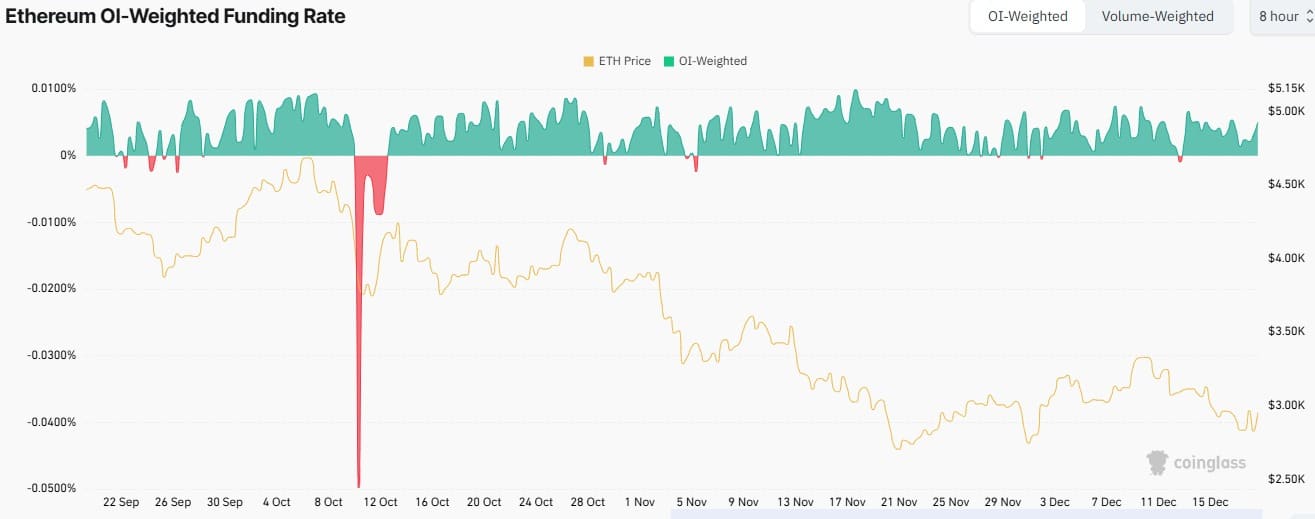

Ethereum Bearish OI-Weighted Funding Spikes, Market Stabilizes

Ethereum’s worth OI-weighted funding charge, displaying what merchants pay or earn on their positions, was principally constructive. Nonetheless, there are transient adverse spikes round October 10–12, indicating short-term bearish stress.

Regardless of these funding charge fluctuations, the ETH worth trended downward general, aligning with adverse funding charge durations and displaying that short-term bearish stress contributed to the decline.

The funding charge has stabilized close to zero, implying a balanced market between longs and shorts. Whereas minor constructive spikes proceed, they haven’t translated into robust upward worth momentum, highlighting cautious or impartial sentiment.

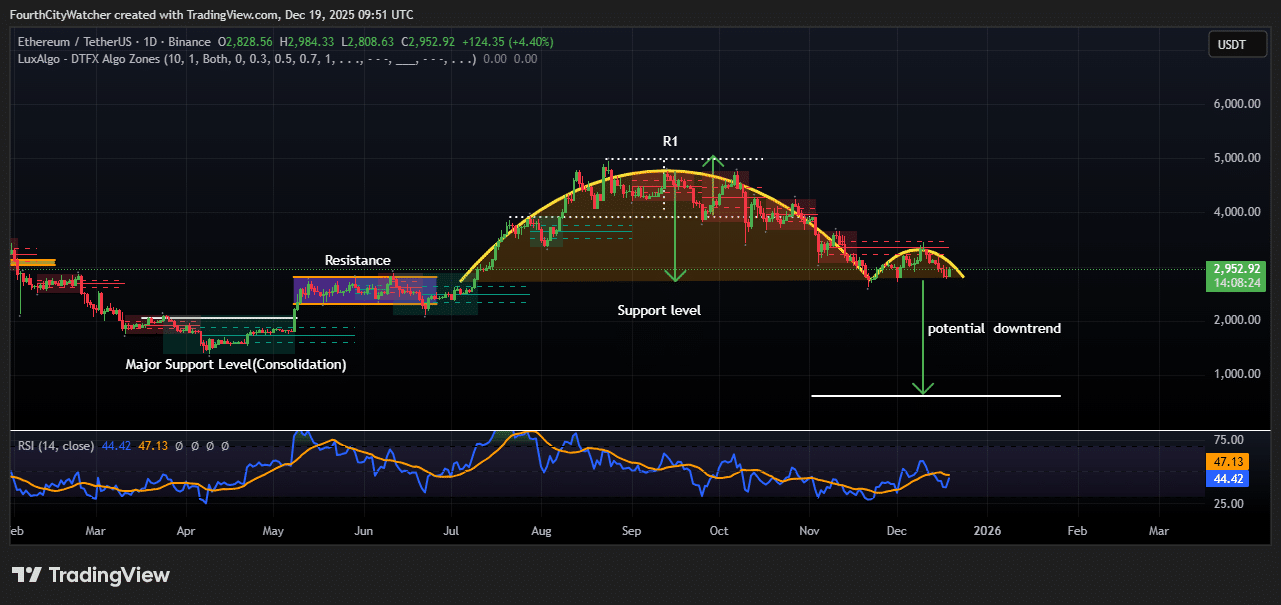

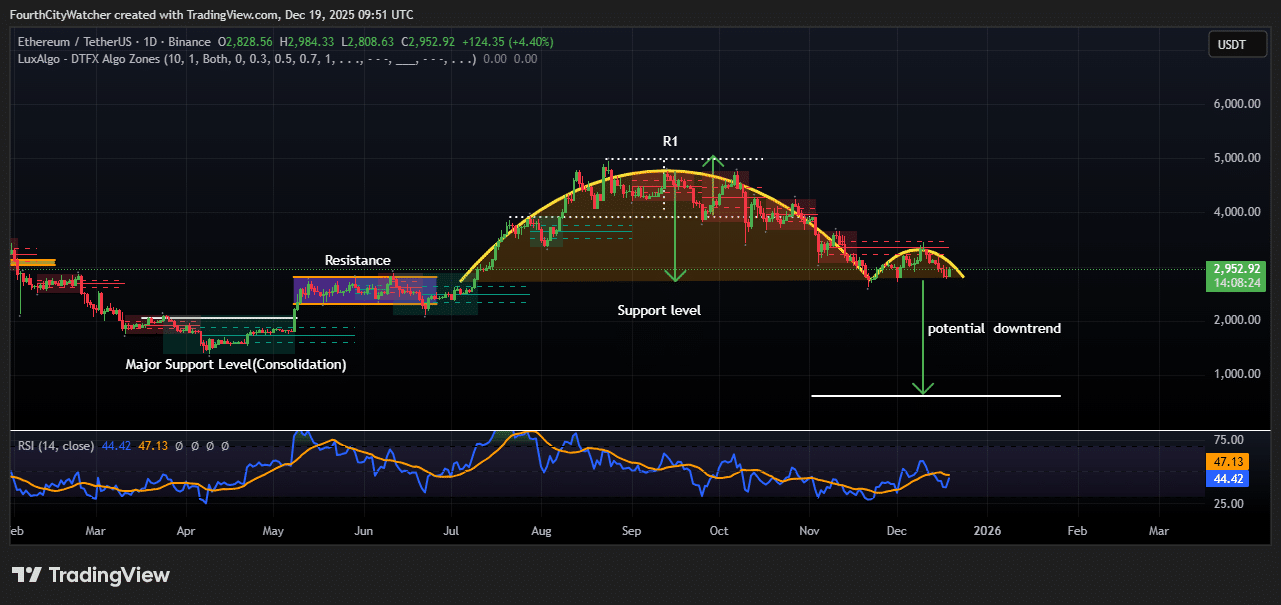

Ethereum Worth Faces Draw back Threat As $2,800 Help Is Examined

The day by day ETH/USDT worth actionshows a transparent transition from consolidation to a potential downtrend between early 2025 and December 19, 2025. From February to April, ETH traded in a good vary and constructed robust assist across the $2,000 degree.

Throughout this part, worth remained steady as consumers and sellers stayed balanced, making a stable base for the transfer greater that adopted.

In Could, ETH broke out of this consolidation and moved upward, however quickly bumped into resistance. Worth motion slowed and commenced to maneuver sideways once more, displaying hesitation amongst merchants and growing promoting stress as consumers struggled to push the value greater.

Between June and September, ETH skilled a robust bullish rally that carried the value towards the $5,000 resistance space. Nonetheless, momentum pale close to this degree, and the chart fashioned a rounded prime that peaked in early September.

The earlier assist inside the uptrend failed, resulting in a worth decline. Though there have been minor rebound makes an attempt, they had been weak and failed to interrupt earlier highs, protecting the general development adverse.

The RSI (14) indicator helps this view, because it moved beneath the 50 degree, displaying weakening shopping for momentum and a better danger of additional draw back.

Presently, ETH trades round $2,957, slightly below a minor resistance space. If the important thing assist close to $2,800 breaks, ETH might proceed falling and retest the earlier main assist zone round $1,000–$1,200.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection