Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value has dropped 1.6% within the final 24 hours to commerce at $4,439.05 as of 5:20 a.m. EST on a 37% improve in each day buying and selling quantity to $31.7 billion.

The hunch within the ETH value comes even after an OG Bitcoin whale with over $5 billion in BTC transformed greater than $400 million price of Bitcoin into Ethereum in current days. The whale offered 4,000 BTC, adopted by one other 1,000 BTC, then used the funds to purchase over 96,000 ETH in a single batch.

This lifted the whale’s Ethereum holdings to greater than 800,000 ETH, price over $4 billion, with most of it staked, signaling long-term dedication.

I’m 100% aligned with virtually all of what Tom @fundstrat says right here.

Sure, Wall Avenue will stake as a result of they at present pay for his or her infrastructure and Ethereum will change a lot of the numerous siloed stacks they function on (e.g. JPMorgam most likely operates on a number of siloed stacks… https://t.co/bW93kkX1gW

— Joseph Lubin (@ethereumJoseph) August 30, 2025

This high-stakes rotation from BTC to ETH comes as Ethereum demand amongst institutional traders grows, serving to ETH outperform BTC lately. Asset managers like BlackRock and VanEck, with new ETH ETF approvals, have introduced billions of {dollars} into Ethereum for purchasers’ portfolios.

Main expertise and gaming companies, in addition to treasury corporations equivalent to Sharplink Gaming, now maintain billions in ETH on their steadiness sheets as they arrange ETH treasury companies.

BlackRock simply filed for a $ETH Staking ETF.

It will entice a brand new wave of institutional traders.

What comes subsequent might be completely huge. pic.twitter.com/6vj8PIi3gV

— Crypto Rover (@rovercrc) July 18, 2025

On the prediction entrance, Ethereum co-founder Joseph Lubin and Fundstrat’s Tom Lee each envision Ethereum’s worth multiplying 100x within the years forward, thanks largely to institutional adoption.

Lubin believes that as Wall Avenue strikes enterprise infrastructure to the Ethereum blockchain, and as extra main banks take part, ETH will cement its function as the first digital asset for institutional treasuries worldwide.

Joseph Lubin and Tom Lee have blazed the path for ETH Treasury corporations. It may’t be overstated how bullish that is for $ETH.

Simply getting began. Unfathomably increased.

Observe ETH treasury firm trade at https://t.co/27787dmiRp pic.twitter.com/IsmfimLfFL

— 🅿🅴🅿🅴🐸🦧🅺🅾🅽🅶(🪈,🪈) (@ThePepeKong) August 8, 2025

Ethereum Worth, Pockets Progress, and Staking Exercise

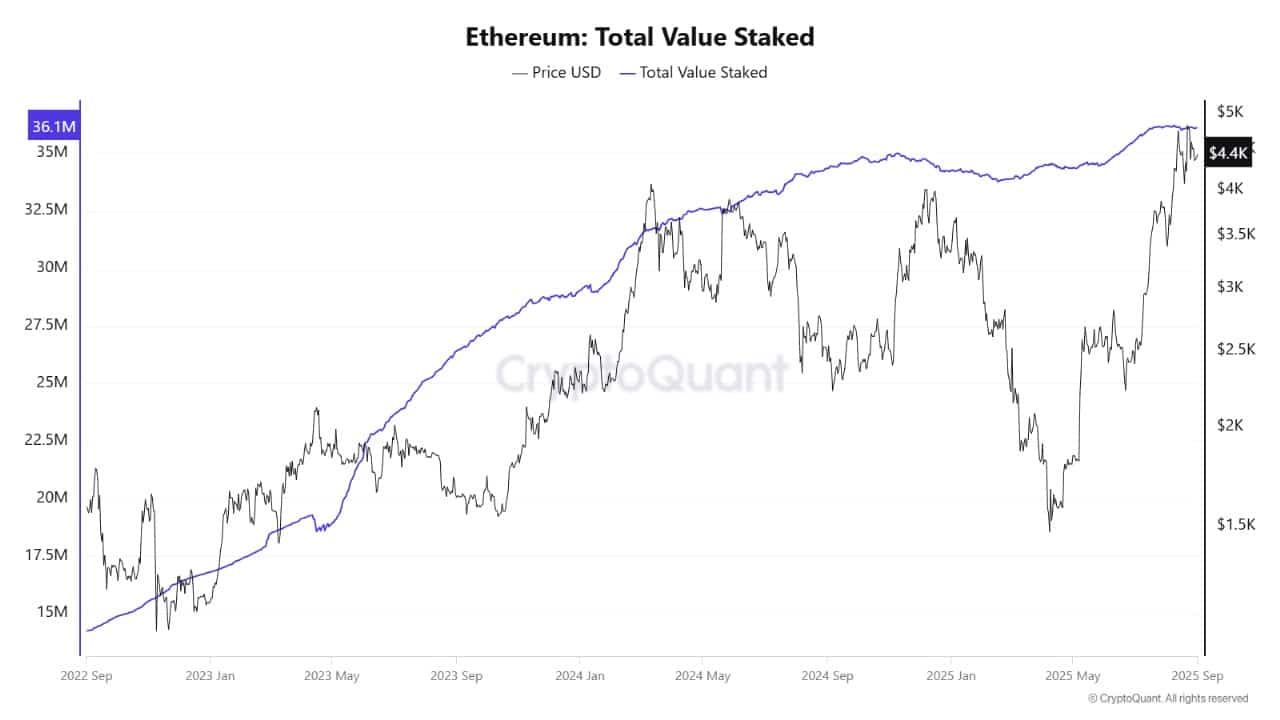

On-chain metrics present robust indicators supporting the newest ETH value development. Massive holders are more and more staking their cash, lowering liquid ETH on exchanges and tightening provide. Almost 5% of Ethereum’s whole circulation has moved into treasury and fund holdings for the reason that begin of the yr.

Ethereum Whole Worth Staked Evaluation Supply: CryptoQuant

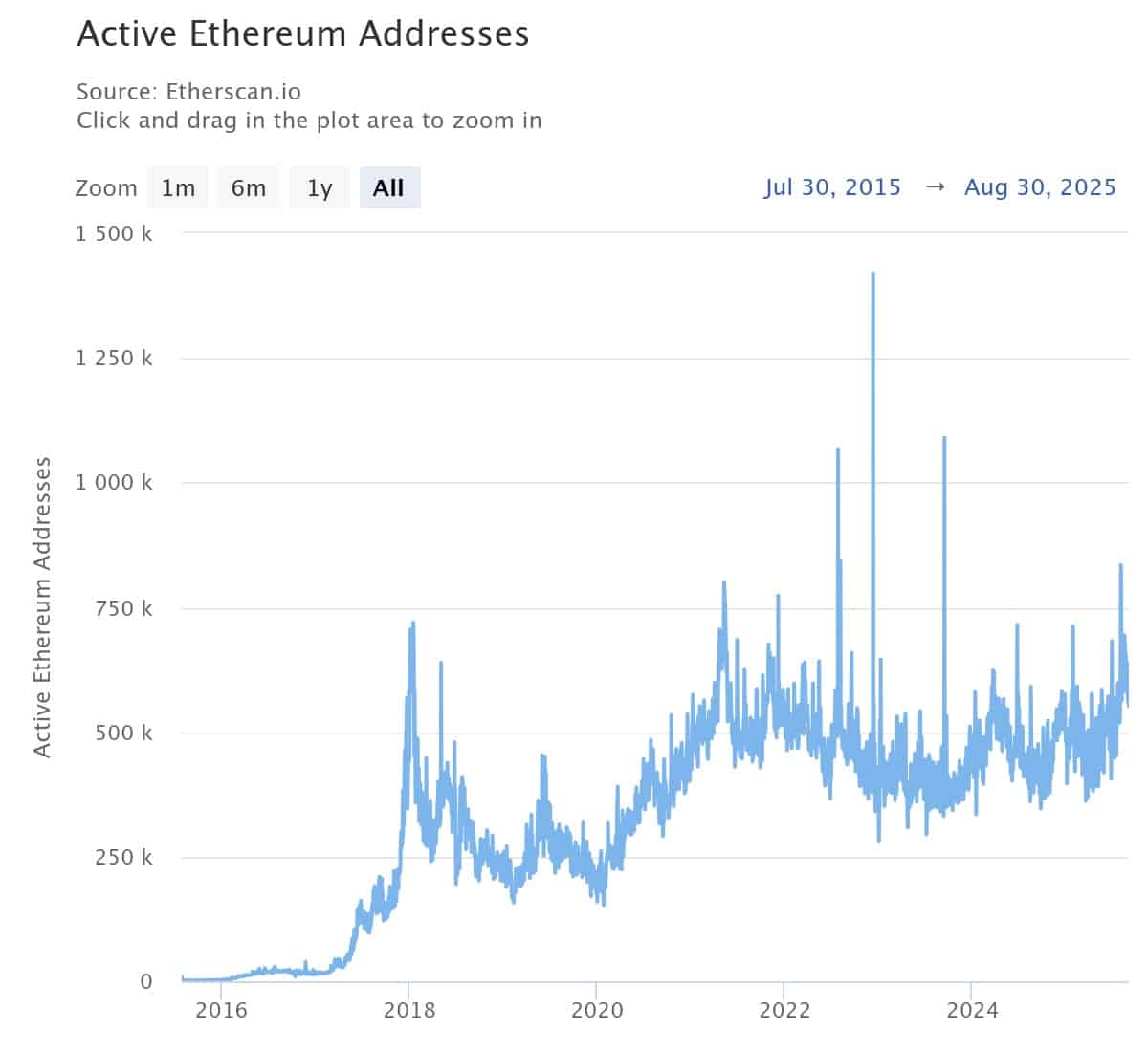

This implies fewer ETH can be found on the market, fueling stability and pushing costs upward. Community participation is excessive, as mirrored in robust transaction volumes and energetic addresses. Staking continues to rise, which appeals to each particular person and institutional traders searching for yield and long-term progress.

Analysts additionally word rising pockets diversification, exhibiting that not solely whales however many new contributors are becoming a member of the Ethereum ecosystem. These tendencies mix to maintain the ETH value buoyant, even when the broader market faces turbulence.

Ethereum Worth: Set To Check New Highs?

Trying on the weekly ETH/USD chart, the Ethereum value is trending upward and lately closed round $4,438. The coin has rebounded laborious from earlier 2025 lows, making increased highs with each transfer.

ETH at present trades above key help ranges: the 50-week easy shifting common at $2,901 and the 200-week at $2,446, highlighting a wholesome long-term uptrend.

The instant help zone sits between $4,323 and $4,375, whereas resistance is seen close to the $4,482 to $4,592 vary. The crucial $5,000 degree is the following psychological barrier and will quickly come into play if the bullish momentum continues.

ETHUSD Evaluation 1-Week Chart. Supply: TradingView

Momentum indicators again the constructive view. The Relative Power Index (RSI) has risen to 67.2, an indication of robust shopping for however not but excessive overbought circumstances. The MACD stays in bullish territory, although merchants are looking ahead to any flip in these indicators that may sign a pause or correction.

Quantity spikes on breakouts by resistance affirm actual demand. If ETH stays above its help ranges, analysts see a powerful probability of testing $4,850–$5,000 within the coming weeks. On the draw back, a drop beneath $4,323 might set off promoting that may check the decrease averages close to $2,900.

The Ethereum value is gaining power from main whale buys, institutional inflows, and bullish predictions from trade leaders. With Joseph Lubin’s 100x prediction echoing throughout Wall Avenue, the ETH value could quickly check new highs.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection