Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth edged up over 1% prior to now 24 hours to commerce at $2,963.47 as of 11:57 a.m. EST, with buying and selling quantity surging 24% to $15.7 billion.

This comes as Jack Yi, founding father of Pattern Analysis, introduced on X that his agency is planning a $1 billion allocation to bolster its Ethereum holdings, which now intensifies its market presence.

我宣布Trend Research再准备10亿美金,在此基础上继续增持买入ETH,我们言行一致,强烈建议不要做空,毫无疑问这将是历史性机会。 https://t.co/bJCjdABpB0

— JackYi (@Jackyi_ld) December 24, 2025

The transfer comes amid appreciable institutional confidence in Ethereum’s future progress and will considerably influence the Ethereum market dynamics. Consequently, it captures consideration amid ongoing funding methods and market volatility.

The choice to put money into ETH goals to bolster the agency’s substantial holdings. Jack Yi emphasised the agency’s dedication to Ethereum, warning towards short-selling, which aligns with Pattern Analysis’s ongoing technique of shopping for ETH throughout worth dips.

These substantial investments are a mirrored image of many establishments’ perception within the token’s long-term worth, reinforcing confidence amongst different institutional buyers and probably stabilizing costs.

In the meantime, this transfer might herald a bigger pattern of institutional curiosity in ETH, probably affecting market construction and regulatory views.

Ethereum Value Struggles For Path As Key Indicators Sign Indecision

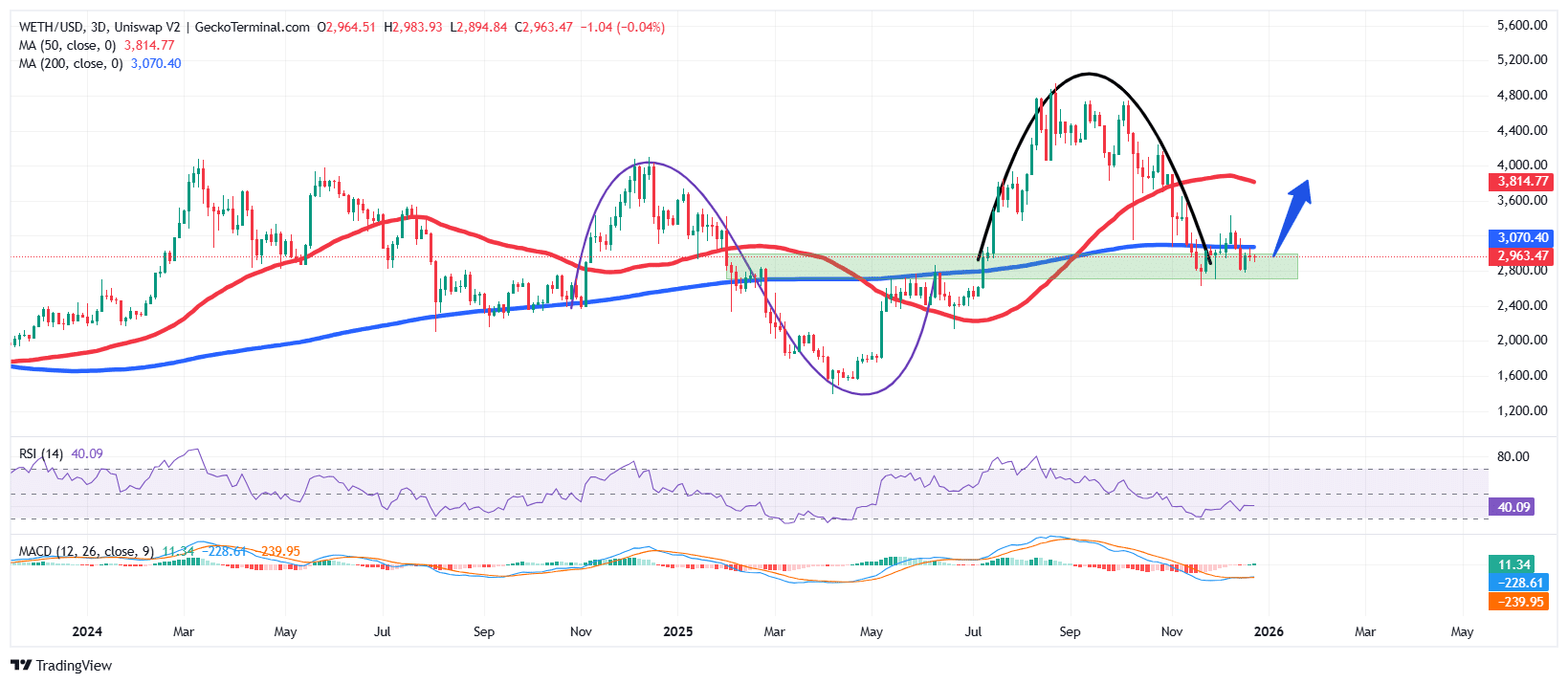

The ETH worth motion has shifted right into a corrective section after staging a robust rally from the mid-2024 assist area close to $2,100.

That push propelled the Ethereum worth towards a cycle peak round $4,900, the place shopping for momentum started to fade, and profit-taking emerged.

Following the rejection on the highs, Ethereum entered a protracted pullback, carving out a rounded high sample and slipping again towards its long-term pattern assist. This retracement has dragged the worth under each the 50-day and 200-day Easy Shifting Averages (SMAs), which now act because the speedy resistance ranges.

In the meantime, the Relative Energy Index (RSI) is hovering round 40, suggesting subdued momentum with out reaching oversold circumstances. This degree displays a stability between patrons and sellers, reinforcing the concept that Ethereum is consolidating quite than trending aggressively in both path.

In the meantime, the Shifting Common Convergence Divergence (MACD) indicator continues to commerce under the zero line, however draw back momentum is weakening. The histogram bars are contracting, signaling that bearish stress is dropping power.

Though no decisive bullish crossover has but shaped, this habits usually precedes a stabilization section or short-term reduction bounce.

ETH Value At A Determination Zone

Primarily based on the ETH/USD chart on the upper timeframe, the ETH worth is at a make-or-break degree. The confluence of the 200 MA and horizontal assist between $2,900–$3,050 kinds a vital demand zone that bulls should defend.

A clear breakdown under this assist area might expose the worth of Ethereum to a deeper transfer towards the following main demand zone close to $2,700, with prolonged weak spot probably revisiting the broader base round $2,100–$2,200.

Conversely, if patrons efficiently defend the 200-day SMA and momentum stabilizes, the worth of ETH might try a restoration towards the prior consolidation vary round $3,400–$3,600.

A sustained push above this area would place the 50-day SMA close to $3,800 again into focus as the following resistance hurdle.

So as to add to the bullish case, crypto analyst Ali Martinez says that ETH energetic addresses have practically doubled in every week, which is a sign of buyers locking in.

Ethereum $ETH community exercise has practically doubled in every week, with energetic addresses rising from 496,000 to 800,000. pic.twitter.com/c0espgmwr9

— Ali Charts (@alicharts) December 25, 2025

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection