Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

New stories point out that the Ethereum (ETH) CrossX indicator is flashing robust purchase alerts, suggesting a possible breakout towards $4,000. Because the market transitions from promoting to purchasing, on-chain knowledge reveals that institutional traders are closely accumulating ETH tokens, indicating a shift in sentiment.

Establishments Load Up On ETH As Purchase Sign Flashes

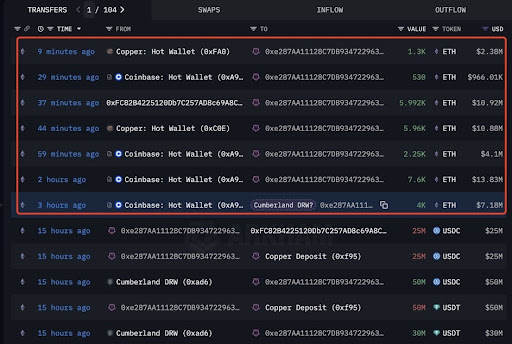

On-chain analytics platform, Lookonchain, has recognized a notable enhance in Ethereum accumulation, largely pushed by institutional whales. Over the course of three hours, a pockets handle reportedly related to the buying and selling agency Cumberland DRW withdrew a staggering 27,632 ETH, price roughly $50.24 million. This switch was constructed from main exchanges, together with Coinbase, Copper and Binance.

Associated Studying

The pockets’s exercise concerned a number of high-value transfers, akin to a 7,600 ETH withdrawal price $13.83 million from Coinbase, a 5,992 ETH withdrawal price $10.92 million from Copper and Binance, and a further 5,960 ETH switch valued at $10.88 million from Copper.

Notably, the receiving pockets, 0ex287AA111…, was persistently used throughout all transactions, suggesting coordinated accumulation somewhat than a typical buying and selling exercise. Traditionally, large-scale withdrawals from Ethereum exchanges have preceded value surges, as they considerably cut back sell-side liquidity and point out a longer-term holding sample by traders.

Amid this rising institutional accumulation, the Ethereum CrossX Indicator, as famous by Ezy Bitcoin on X, has not too long ago flashed a powerful purchase sign. This reinforces the notion that institutional curiosity is rising, signaling a rise in demand and doubtlessly setting the stage for additional upward value motion.

Ethereum CrossX Indicator Suggests $4,000 Surge Forward

Shedding extra gentle on Ezy Bitcoin’s report, the CrossX indicator, which formally triggered a purchase sign for Ethereum, is signaling a potential surge above $4,000 for the altcoin’s value. The market professional highlights that that is the primary sign seen in practically six months and, traditionally, has typically preceded important value motion and explosive strikes.

Associated Studying

The CrossX Indicator, a software used to detect high-probability development reversals primarily based on quantity, value motion, and divergence patterns, has proven exceptional accuracy in previous cycles. As seen within the analyst’s weekly chart, earlier purchase alerts had been adopted by rallies that took ETH to new native highs.

Now, with Ethereum’s value rebounding off current lows and a contemporary Bullish Divergence in place, the identical rally sample could also be unfolding once more. If historical past repeats, ETH may very well be gearing up for a run past $3,000, with the opportunity of testing the $4,200 vary by yr’s finish.

In accordance with CoinMarketCap’s knowledge, Ethereum is at present buying and selling at $1,803, reflecting a yearly decline of 43.10%. A possible rise to $4,200 would characterize a staggering 132.95% enhance, bringing Ethereum (ETH) nearer to its current all-time excessive of over $4,800.

Featured picture from Adobe Inventory, chart from Tradingview.com