On-chain knowledge reveals the Ethereum alternate netflow has witnessed a adverse spike through the previous week, a possible signal that traders have been accumulating.

Ethereum Change Netflow Has Been Pink For The Previous Week

As identified by institutional DeFi options supplier Sentora in a brand new put up on X, Ethereum has seen internet outflows from exchanges previously week. The indicator of relevance right here is the “Change Netflow,” which measures the web quantity of ETH that’s transferring into or out of wallets linked with centralized exchanges.

When the worth of this metric is constructive, it means the traders are depositing a internet variety of tokens to those platforms. As one of many foremost explanation why holders deposit their cash to exchanges is for selling-related functions, this type of pattern may be bearish for the asset’s value.

Alternatively, the indicator being beneath zero suggests outflows are dominating the inflows on exchanges. Such a pattern could be a signal that traders are in a part of accumulation, which may naturally be bullish for the cryptocurrency.

As the info shared by Sentora reveals, Ethereum has seen a weekly Change Netflow worth of -$978.45 million, indicating that merchants have made an enormous quantity of internet withdrawals.

The numerous outflows have come as Ethereum has witnessed a decline through the previous week. As Sentora explains:

This indicators aggressive accumulation the place traders are doubtless “shopping for the dip” and withdrawing property to chilly storage or on-chain environments, tightening the liquid provide regardless of the adverse value momentum.

The worth drawdown previously week has additionally accompanied a drop within the complete transaction charges on the community, which means that switch exercise has gone down. The blockchain noticed about $2.64 million in charges over the past week, which is greater than 15% down week-over-week.

ETH Noticed A Transient Go to Below $2,800 Earlier than Rebounding

Ethereum noticed a decline to $2,780 on Thursday, however the asset was capable of bounce again because it’s now floating just below $3,000.

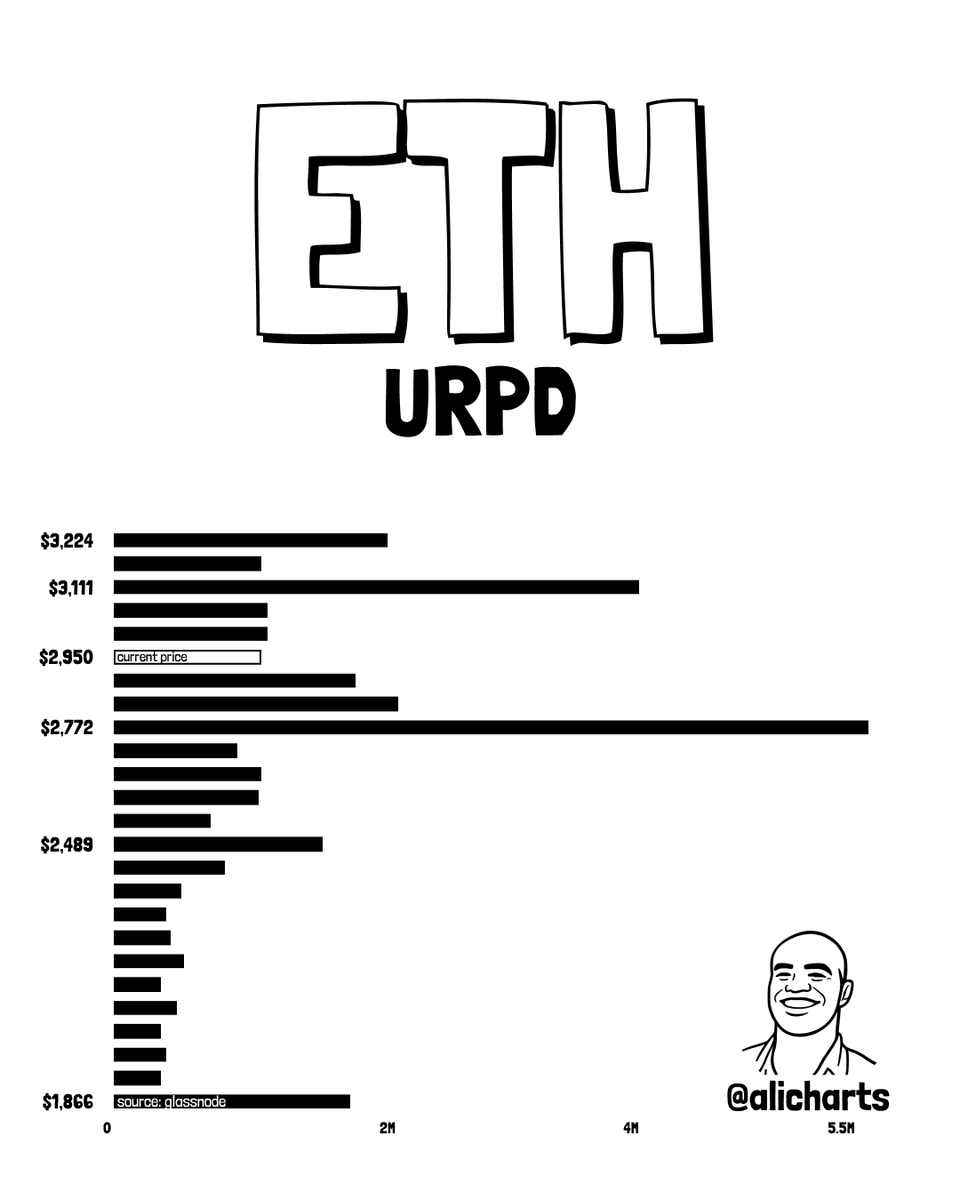

Apparently, ETH’s backside was across the identical degree as a significant on-chain provide cluster, as a chart shared by analyst Ali Martinez in an X put up reveals.

Within the graph, Martinez has connected the info of the Ethereum UTXO Realized Worth Distribution (URPD) from on-chain analytics agency Glassnode. This metric mainly tells us how a lot ETH provide was final transacted on the varied value ranges that the coin has visited in its historical past.

There’s a enormous provide zone situated at $2,772 on the URPD, suggesting a considerable amount of traders have their price foundation at it. Typically, such ranges act as a help boundary throughout downtrends, as merchants who bought there purchase the dip to defend it.