Be part of Our Telegram channel to remain updated on breaking information protection

The BNB token recorded $3.6 billion in buying and selling quantity, as the worth fell again to commerce throughout the falling wedge sample, because the Binance alternate disclosed plans to transform the SAFU fund’s $1 billion stablecoin reserves into Bitcoin inside 30 days to revive the fund to $1 billion if worth fluctuations push its worth under $800 million.

Binance Coin worth has dropped 5.1% within the final 24 hours to $841.54 as of 04:04 a.m. EST, because the crypto market additionally fell over 5% to $2.89 trillion, in response to Coingecko information.

On account of this continued drop, BTC dropped sharply, reaching its lowest stage in over two months, as a wave of pressured liquidations hit leveraged merchants whereas traders weighed the potential affect of a US Federal Reserve management change.

Knowledge from Coinglass present that roughly $1.74 billion in leveraged positions have been worn out over the previous 24 hours amid the sell-off, with 93% of those coming from lengthy positions.

Binance To Shift $1 billion Consumer Safety Fund Into Bitcoin

Binance, the world’s largest crypto alternate by buying and selling quantity, introduced a plan to transform your complete $1 billion reserve of its Safe Asset Fund for Customers (SAFU) from stablecoins into BTC over the following 30 days.

The fund was created to guard customers from losses attributable to unexpected occasions, akin to information breaches. It added that if bitcoin’s worth swings drop the fund’s worth under $800 million, the alternate will prime it again as much as $1 billion.

“This initiative is a part of Binance’s long-term industry-building efforts, and we are going to proceed to advance associated work, steadily sharing extra progress with the neighborhood,” Binance mentioned on X.

— 币安Binance华语 (@binancezh) January 30, 2026

Beneath the outlined plan, the alternate will steadily purchase BTC as a approach of avoiding sudden market disruption, a daring transfer by a centralized alternate to again up consumer funds with BTC.

Changing $1 billion over 30 days implies roughly $33 million in every day BTC purchases, which may, in flip, assist stabilize the cryptocurrency’s drawdowns.

Moreover, with the $800 million rebalance threshold, Binance will commit to purchasing the dip if the BTC worth falls sharply.

CZ Denies Massive-Scale BNB Promoting By Binance

Because the crypto market corrected, Binance founder Changpeng ‘CZ’ Zhao denied allegations that the alternate engaged in large-scale promoting of assorted cryptocurrencies, which can have contributed to the sustained market decline.

In line with CZ, the adverse rumors are dangerous to the broader market however not personally impactful.

FUD does not harm the goal. My followers elevated.

FUD hurts the market (ie everybody).

I/Binance don’t promote in any significant quantities.

My promoting = I swipe my card and $5 value of BNB will get transformed/despatched to the espresso store.

I do not run Binance anymore, however primarily based on what I…

— CZ 🔶 BNB (@cz_binance) January 30, 2026

In line with CZ, he and Binance haven’t engaged in any “significant” promoting actions, and any private gross sales have been restricted to every day bills.

CZ’s feedback comply with allegations that the co-founder and the alternate have engaged in market manipulation and self-serving practices through the years.

Engaged on a comply with up article for these ….

Simply as Binance are nuking the market https://t.co/xgyg24N9Pn pic.twitter.com/vbNC8QB39C

— $trong (@StrongHedge) January 29, 2026

BNB Value Drops Beneath Key Assist, Dangers A Sustained Plunge

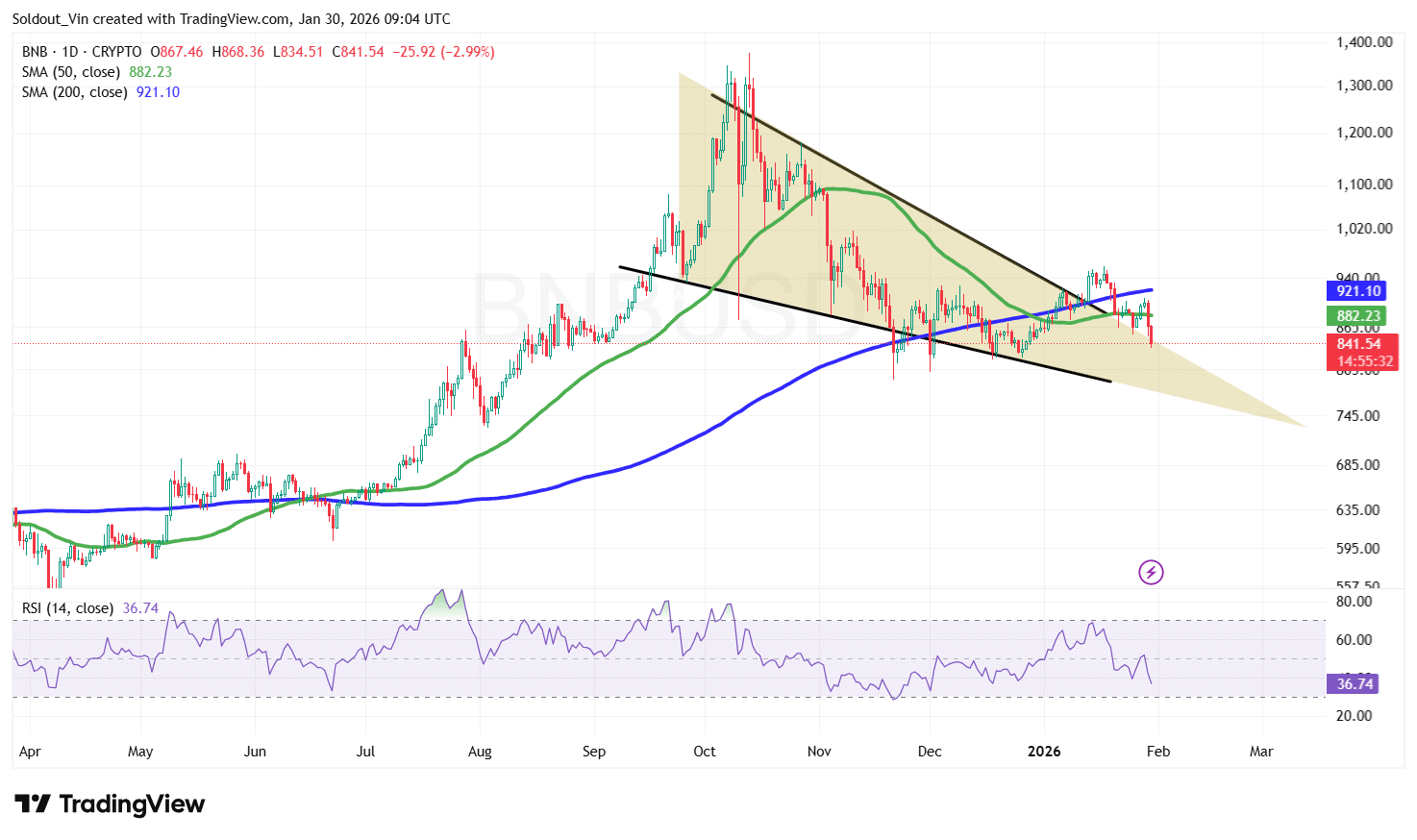

The BNB worth has fallen again under the 50-day Easy Transferring Common (SMA), reinforcing the narrative of a sustained decline.

After a dramatic surge in October 2025, Binance Coin entered a correction and started buying and selling inside a well-defined falling wedge sample.

After a breakout early this yr, the worth of BNB is again under the decrease boundary of the wedge, as sentiment modified to bearish.

BNB’s Relative Power Index (RSI) additionally helps the general bearish pattern, because it continues to drop in the direction of the 30-oversold area, at the moment at 36.74.

With the worth of the Binance Coin dropping again throughout the higher boundary of the falling wedge sample, the outlook is at the moment bearish, as the worth now dangers a sustained drop again deep throughout the wedge.

If the bears proceed to exert strain, BNB dangers a continued downtrend in the direction of the $820.63 assist space, which acted as a powerful demand space in late 2025. This may very well be pushed by the SMAs forming round $884.27, with the 200-day SMA shifting above the 50-day SMA.

Conversely, if the Binance Coin reclaims the 50-day SMA resistance stage round $882.23 and manages to shut above the 200-day SMA ($921), the following key goal would be the $1,000 psychological zone.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection