Be part of Our Telegram channel to remain updated on breaking information protection

BlackRock’s iShares Bitcoin Belief (IBIT) has entered the highest 20 checklist of the most important ETFs (exchange-traded funds) for the primary time, with its belongings reaching $90.7 billion.

In response to an X submit by Bloomberg ETF analyst Eric Balchunas, IBIT is now ranked beneath the Vanguard Dividend Appreciation ETF (VIG US) with its $98 billion in belongings, and above the Expertise Choose Sector SPDR Fund (XLK US) with its belongings standing at $90.6 billion.

That’s after BlackRock’s spot Bitcoin ETF recorded its greatest web every day inflows since Aug. 14.

Analyst Says IBIT Might Enter High 10 Round December 2026

Requested when or if IBIT might enter the highest ten checklist, Balchunas stated the milestone ”could not take lengthy.”

“It took in $40b final 12mo and went up 85%,” Balchunas wrote, estimating it might enter the highest 10 round Christmas subsequent 12 months.

Somebody requested me how lengthy until High 10. It’s $50b away. If the final 12mo are repeated it could not take lengthy. It took in $40b final 12mo and went up 85%. That stated, these different ETFs rising too so i do not know. If pressured i might set the over/beneath for Xmas 2026.

— Eric Balchunas (@EricBalchunas) October 1, 2025

Spot Bitcoin ETFs Proceed Influx Streak, Pull In Over $1.5 Billion In 3 Days

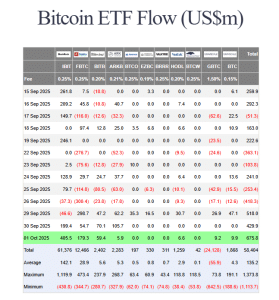

IBIT’s entry into the highest 20 comes amid a multi-day influx streak for US spot Bitcoin ETFs. Within the newest buying and selling session, the merchandise pulled in one other $675.8 million, information from Farside Buyers exhibits. This was the ETFs’ highest web every day inflows since Aug. 14.

US spot Bitcoin ETF flows (Supply: Farside Buyers)

BlackRock’s IBIT led the cost within the newest buying and selling session, with buyers pouring in $405.5 million into the fund. The subsequent-biggest web every day inflows had been posted by Constancy’s FBTC, which noticed $179.3 million inflows on the day.

Different funds that recorded web every day inflows within the newest buying and selling session had been Bitwise’s BITB, ARK Make investments’s ARKB, VanEck’s HODL, in addition to each of Grayscale’s funds.

In the meantime, Invesco’s BTCO, Franklin Templeton’s EZBC, Valkyrie’s BRRR and WisdomTree’s BTCW recorded no new flows on the day.

With yesterday’s inflows, the US spot Bitcoin ETFs prolonged their constructive move streak to 3 days as effectively. Throughout this era, the merchandise have pulled in additional than $1.5 billion

BlackRock’s IBIT stays the spot Bitcoin ETF of alternative, and leads by way of cumulative web inflows. Buyers have poured $61.376 billion into the fund since its launch final 12 months.

In a Sept. 30 X submit, Balchunas commented on the funds’ efficiency so far, noting that the spot Bitcoin ETFs took in $7.8 billion within the third quarter this 12 months.

The Bloomberg analyst added that the funds have additionally pulled in $21.5 billion year-to-date, and $57 billion since inception. Nevertheless, some buyers are nonetheless upset with how the merchandise are performing.

Balchunas went on to criticize these buyers who he says “dwell in infantile fantasy” and are upset that the funds aren’t seeing “$1T of inflows daily.”

The spot bitcoin ETFs took in $7.8b in Q3, now $21.5b YTD and $57b since inception. Strong climb up. But some on listed below are depressing bc they dwell in infantile fantasy that expects $1T of inflows daily. However actual development in actuality is 2 steps fwd, one step again. by way of @JSeyff pic.twitter.com/dAEJJTOYWW

— Eric Balchunas (@EricBalchunas) September 30, 2025

Nasdaq Submits Submitting To Record BlackRock’s Bitcoin Premium Revenue ETF

As IBIT continues to carry out, Nasdaq has not too long ago filed with the US Securities and Trade Fee (SEC) to checklist and commerce the asset administration big’s iShares Bitcoin Premium Revenue ETF.

BlackRock’s new fund features a coated name mechanism that can generate constant yield by means of Bitcoin publicity.

Whereas IBIT tracks the spot worth of Bitcoin, the Premium Revenue ETF provides an choices overlay to extract further revenue. The belief will make investments primarily in BTC, IBIT shares, and money reserves, in response to the submitting.

The SEC has already acknowledged that the submitting complied with the final itemizing standards. As such, the general public remark interval on the proposed rule change has been initiated.

Blachunas described the brand new fund as a “sequel” to IBIT, and stated the product shouldn’t be meant to diversify into different cryptos, however is as a substitute meant to supply extra choices for funding inside the Bitcoin ecosystem.

The brand new product submitting comes after Bloomberg reported that IBIT not too long ago surpassed Coinbase’s Deribit platform to grow to be the most important venue for Bitcoin choices buying and selling. Open curiosity in choices tied to IBIT reached practically $38 billion, whereas choices tied to Deribit solely reached $32 billion.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection