Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value slipped a fraction forward of key US inflation information tomorrow with merchants more and more unsure over the probability of a December charge reduce by the Federal Reserve.

BTC slid to as little as $102,457.33 up to now 24 hours however has recovered to commerce at $104,555.73 as of 5:52 a.m. EST. Greater than $317 million in leveraged lengthy positions have been liquidated up to now 24 hours, in line with Coinglass.

BTC value (Supply: CoinMarketCap)

That’s left merchants targeted on the US CPI (Client Worth Index) report back to be launched tomorrow. It will likely be a key gauge of what to anticipate from the Federal Reserve’s subsequent rate of interest determination.

Market expectations for a December charge reduce have weakened, with the CME FedWatch software exhibiting the chances dropping to 67.9%, from 85% final week, after Fed Chair Jerome Powell warned that further cuts are “not a accomplished deal.”

A better-than-expected inflation studying might dampen hopes for additional easing, whereas softer inflation could revive danger urge for food throughout crypto markets.

POWELL SAYS A RATE CUT IN DECEMBER IS NOT A FOREGONE CONCLUSION.

BEARISH STATEMENT… pic.twitter.com/XvrRQQavr6

— Mister Crypto (@misterrcrypto) October 29, 2025

Including to the uncertainty is a Wall Avenue Journal report earlier at present that stated the US central financial institution has turn out to be more and more divided over a December charge reduce.

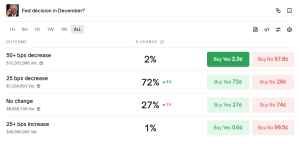

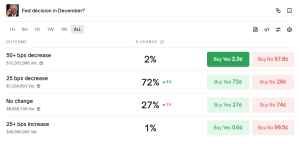

Contract asking what the Fed’s determination will likely be in December (Supply: Polymarket)

Merchants on the decentralized predictions market Polymarket stay optimistic that there will likely be a charge reduce subsequent month. In a contract asking what the Fed’s determination will likely be, Polymarket merchants have positioned 72% odds that there will likely be a 25 foundation factors reduce.

Bitcoin Worth Checks Main Technical Barrier As Morgan Stanley Says Take Good points

From a technical perspective, the Bitcoin value is making an attempt to beat a serious barrier on the $105,795 resistance degree.

Every day chart for WBTC/USD (Supply: GeckoTerminal)

That value degree is confluent with the 9 and 20 Exponential Shifting Averages (EMAs), that are at the moment performing as dynamic resistance ranges for BTC. As such, flipping the resistance degree into help would possibly result in a bullish reversal of the market chief’s present pattern. This might then end in a climb to as excessive as $110,830 within the quick time period.

Nonetheless, failure to shut above the $105,795 resistance degree inside the subsequent 48 hours would possibly end in a pullback to the closest help at $99,680.

Technical indicators on the every day chart, such because the Shifting Common Convergence Divergence (MACD) and the Relative Energy Index (RSI), present that consumers are slowly making a comeback, however they nonetheless want to beat the $105,795 barrier earlier than they’ll ignite a rally.

Whereas Bitcoin tries to beat a serious technical barrier, Morgan Stanley funding strategist Denny Galindo has urged buyers to take income in preparation for a crypto winter.

“We’re within the fall season proper now,” he stated. “Fall is the time for harvest. So, it’s the time you need to take your features. However the debate is how lengthy this fall will final and when the following winter will begin.”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection