In latest weeks, Ethereum has displayed refined indicators of restoration amidst a typically bearish crypto market, with the altcoin mimicking Bitcoin’s modest uptrend.

Regardless of Ethereum’s worth growing barely by 0.2% during the last 24 hours, a parallel development which may considerably have an effect on Ethereum’s financial mannequin has been unfolding beneath the floor.

Decline In Community Exercise Reduces ETH Burn

April witnessed Ethereum’s ETH burn fee hitting an annual low, primarily as a result of a major lower in community transaction charges.

These charges have usually fluctuated just under 10 gwei this yr, however latest weeks have seen them dip to among the lowest ranges, immediately influencing the speed at which ETH is burned.

This lowered burn fee is evidenced by the stark drop in each day burned ETH, which reached a low of 671 ETH prior to now day a notable lower from the each day figures of two,500–3,000 ETH seen earlier within the yr.

Such a decline in burn fee just isn’t merely a statistical anomaly however a mirrored image of broader shifts throughout the Ethereum community.

A big issue contributing to the lowered gasoline charges is the elevated migration of community actions to Layer 2 options, which improve transaction speeds whereas decreasing prices.

Furthermore, improvements like blob transactions, launched in Ethereum’s latest Dencun improve, have additional optimized prices on these secondary layers.

Notably, Blobs are a characteristic launched to reinforce Ethereum’s compatibility with Layer 2 options like zkSync, Optimism, and Arbitrum by effectively managing knowledge storage wants. This performance is a part of the Dencun improve, which integrates proto-danksharding through EIP-4844.

Whereas useful in decreasing transaction charges, these technological strides pose challenges to Ethereum’s deflationary mechanisms.

This improve launched a brand new charge construction by which part of each transaction charge, the bottom charge, is burned, doubtlessly decreasing the general ETH provide. Nonetheless, with decreased transaction charges, the anticipated deflationary stress through burning has softened, signaling a shift to a extra inflationary development within the quick time period.

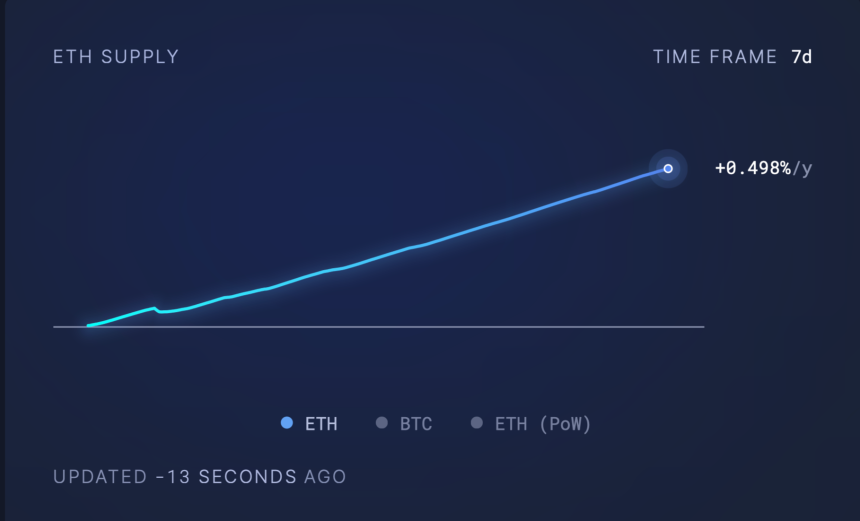

In line with Ultrasoundmoney, Ethereum’s provide dynamics have swung to a mildly inflationary mode with a development fee of 0.498%. This shift might realign if community exercise intensifies, resulting in elevated transaction charges and, consequently, larger burn charges.

Ethereum Market Response

Regardless of these underlying community dynamics, Ethereum’s market worth has struggled to regain its former highs above $3,500. The asset trades round $3,085, reflecting a slight downturn over latest weeks.

This worth habits underscores the broader market’s response to inside community modifications and exterior financial elements, resembling regulatory struggles from the US Securities and Change Fee (SEC) and macroeconomic uncertainties.

Wanting forward, the trajectory of Ethereum’s gasoline charges and subsequent ETH burn fee will likely be essential in figuring out the sustainability of its financial mannequin.

Featured picture from Unsplash, Chart from TradingView