Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value has climbed by a fraction of a proportion within the final 24 hours to commerce at $2908 after Bitmine disclosed one other important enhance in its Ethereum holdings through the closing week of January, including to a rising pattern of large-scale ETH accumulation by establishments and company entities.

In keeping with a current press launch, the digital asset agency, chaired by market strategist Tom Lee, bought 40,302 ETH final week, bringing its complete crypto and money holdings to roughly $12.8 billion as of January 25.

This buy follows the same acquisition only one week earlier, when Bitmine purchased 35,268 ETH. In complete, the corporate now holds about 4.2 million ETH, alongside 193 Bitcoin, and maintains $682 million in money reserves. Bitmine’s Ethereum holdings symbolize roughly 3.52% of ETH’s complete circulating provide. Of this quantity, greater than 2 million ETH is at present staked.

Tom Lee highlighted the dimensions of Bitmine’s staking operations, stating that the agency has staked extra ETH than every other entity globally. As soon as all of Bitmine’s ETH is absolutely staked by MAVAN and its companions, the corporate expects to earn round $374 million yearly in staking rewards, primarily based on a 2.81% CESR. This interprets to greater than $1 million in every day staking charges.

Bitmine Raises Ethereum Stake

Past crypto property, Bitmine additionally holds strategic fairness investments. These embody a $200 million stake in Beast Industries, the corporate behind YouTuber MrBeast, and $19 million allotted to high-risk “moonshot” investments. Tom Lee beforehand defined that the MrBeast funding aligns with Bitmine’s objective of driving broader mainstream adoption of Ethereum.

Regardless of the huge ETH accumulation, Bitmine’s inventory (BMNR) declined following the announcement. BMNR is buying and selling round $28.52, reflecting broader weak point within the crypto market as each Bitcoin and Ethereum face promoting stress. Ethereum has dropped beneath the important thing $3,000 help stage and is buying and selling close to $2,900, erasing its year-to-date features.

In the meantime, Ethereum whale accumulation continues. Latest on-chain knowledge reveals new wallets buying tens of 1000’s of ETH, whereas establishments like World Liberty Monetary have rotated funds from Bitcoin into Ethereum, signaling ongoing strategic shifts towards ETH regardless of short-term value weak point.

Ethereum Eyes Restoration After Testing Main Help at $2,880

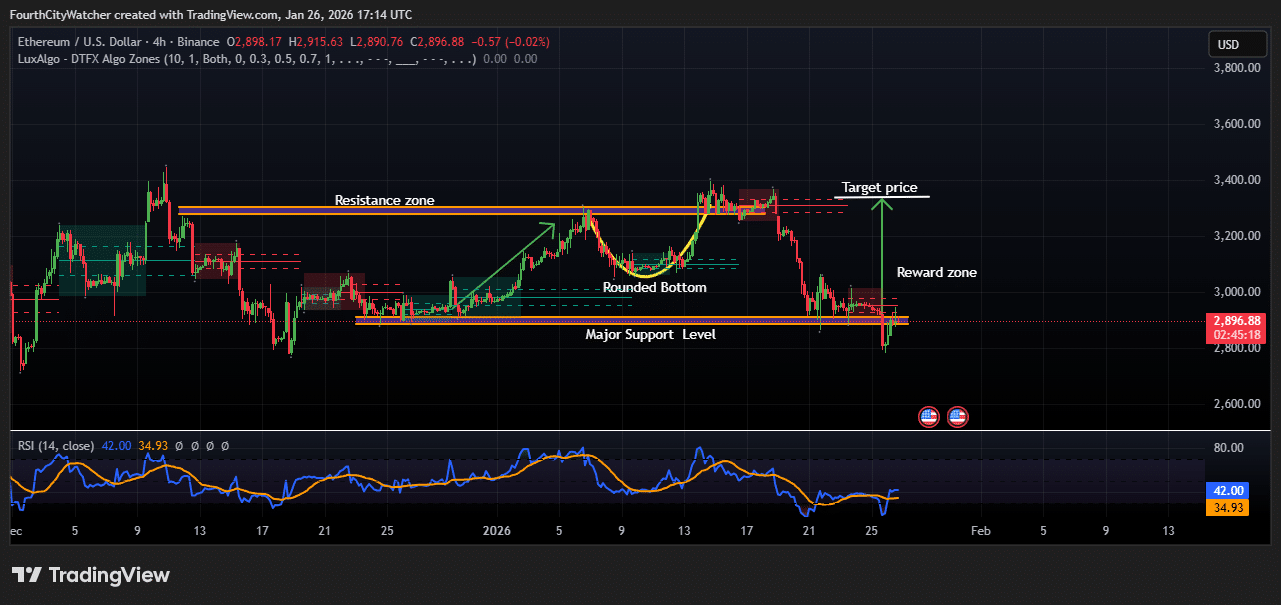

Ethereum value indicators stabilization after a current drop beneath the important thing $3,000 psychological stage. The chart reveals ETH is buying and selling at $2,906, reflecting a modest 0.31% enhance over the previous 24 hours, as merchants carefully watch the cryptocurrency’s subsequent directional transfer.

Evaluation of the 4-hour chart highlights a essential main help stage close to $2,880, which has held a number of instances over the previous month. A bounce from this stage means that consumers are stepping in to defend the value, creating a possible reward zone for short-term upward actions.

Merchants are eyeing a attainable rally towards the resistance zone round $3,300–$3,350, which aligns with earlier swing highs and represents the goal value for bullish momentum. The chart additionally reveals a rounded backside sample, which shaped in early January and signifies accumulation and a possible reversal from bearish to bullish sentiment.

If this sample performs out, ETH might check the higher finish of the reward zone, providing merchants a good risk-to-reward setup.

ETHUSD Chart Evaluation. Supply: Tradingview

The Relative Energy Index (RSI) at present reads 43.95, exhibiting that ETH stays barely beneath impartial territory however has begun to pattern upward from the oversold area. This means that downward stress could also be easing, and momentum might steadily shift in favor of consumers if quantity helps the transfer.

Regardless of short-term weak point, Ethereum continues to draw consideration from institutional traders, and whale exercise has intensified, signaling confidence within the mid- to long-term outlook. Nonetheless, merchants are cautioned {that a} failure to keep up help close to $2,880 might open the door to additional draw back, probably retesting $2,800 or decrease.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection