Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth dropped 1% within the final 24 hours to commerce at $121,453 as of 4 a.m EST on a 27% lower in buying and selling quantity to $59.41 billion.

This comes after dealer Peter Brandt informed his 810k followers on X that Bitcoin might expertise a dramatic surge quickly, probably exploding as excessive as $185,000 per coin.

However he additionally cautioned that the highest of the cycle could be close to, and a reversal might comply with if Bitcoin fails to interrupt its common cycle sample this week.

Veteran dealer Peter Brandt simply dropped a bomb:

If $BTC doesn’t prime out quickly, we’re heading into transfer properly past $150K, perhaps even $185K.

Cycles don’t lie… and this one’s three-for-three.

Don’t fade historical past.#BTC #CryptoTrading #Crypto #Bullish pic.twitter.com/8CO4NJSwrS

— SushiBrain🍣🔺 (@SushiBrain_ETH) October 9, 2025

Brandt outlined his concept by Bitcoin’s four-year cycle construction. In previous cycles, the time between the underside and the halving has usually matched the time from halving to the value peak. For this cycle, the low occurred in November 2022, 533 days earlier than the April 2024 halving.

Including one other 533 days pointed to early October 2025, proper when Bitcoin hit a brand new all-time excessive of over $126,000. “If Bitcoin blows via the cycle prime, the strikes that comply with may be explosive,” Brandt stated, suggesting that $185,000 is feasible, perhaps even larger.

Different analysts are watching carefully. Rekt Capital predicts that if cycles comply with previous developments, the market peak might arrive this month.

Economist Timothy Peterson gave Bitcoin a 50% likelihood of closing October above $140,000, whereas extra bullish voices like Arthur Hayes and Joe Burnett mission targets nearer to $250,000 earlier than the tip of 2025.

Bitcoin’s getting into the joys zone of the four-year cycle.

Historical past says we might go previous $200,000 in 2025.

—I take advantage of an influence curve becoming of Bitcoin’s historic USD worth to seize the long-term development. Then, I measure worth deviation from that development utilizing the metric “years… pic.twitter.com/fkZZRPI4Eh

— apsk32 (@apsk32) September 13, 2025

As Brandt reminds merchants, cycles ultimately change, so it pays to remain alert in case the market defies expectations.

Bitcoin Worth Rally Fueled By Massive Cash And On-Chain Traits

On-chain metrics verify this bullish setup. Blockchain information factors to a pointy lower in trade balances. Patrons are shifting cash off exchanges into personal wallets, signalling fewer rapid sellers and extra long-term holders.

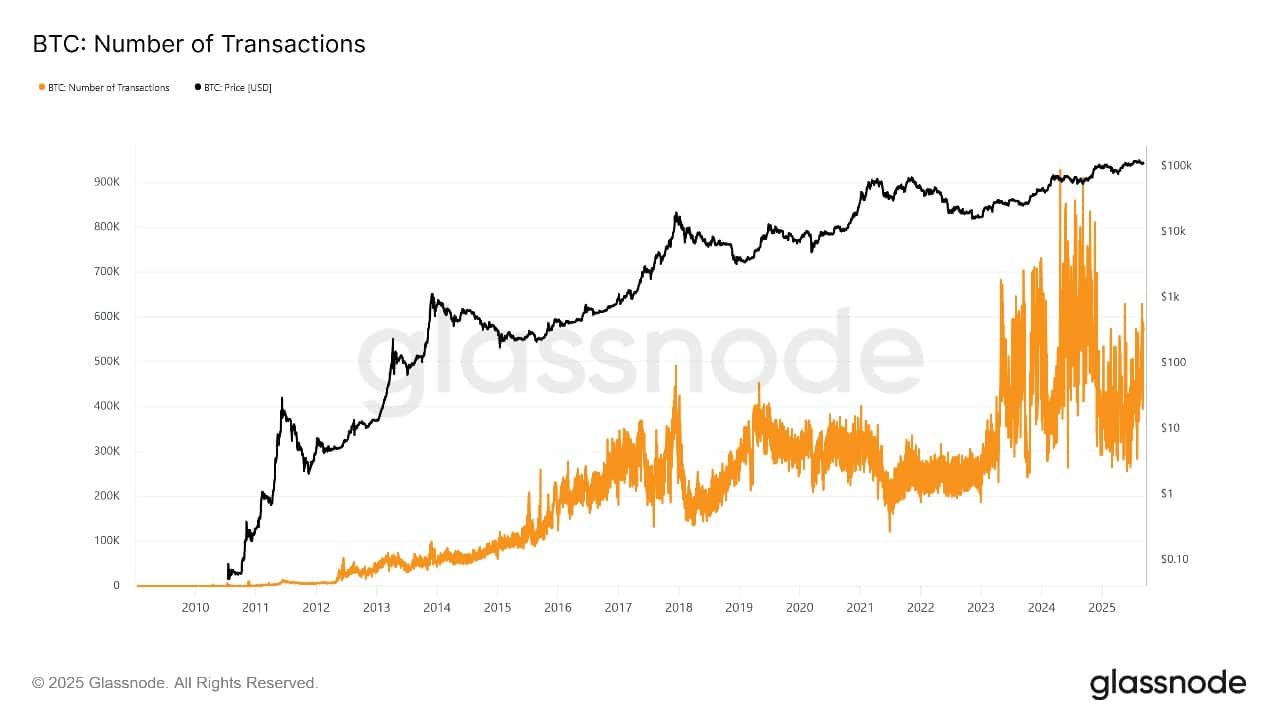

The variety of lively addresses and transaction counts has additionally climbed, displaying actual consumer engagement and community demand. Analysts say that the provision squeeze is intensifying, with long-term holders absorbing extra cash as short-term merchants step apart.

BTC Variety of Energetic Addresses Supply: Glassnode

After peaking in August, Bitcoin’s worth entered a interval of wholesome correction and consolidation throughout September. This part helped clear short-term hypothesis and switch cash into the palms of dedicated traders, constructing a tighter base for the subsequent massive transfer.

The October rally triggered huge liquidations of bearish positions, with a reported $330 million in shorts pressured to purchase again larger. This “brief squeeze” fueled the explosive breakout, serving to cement Bitcoin’s new larger buying and selling vary.

ETF flows stay a key story for coin worth. As property beneath administration balloon, consultants consider institutional adoption will hold upward stress on Bitcoin’s worth. Treasury adoption by firms and even sovereign entities is predicted so as to add one other layer of assist within the months forward.

Bitcoin Worth Prediction: Bulls In Management However Some Dangers Stay

Wanting on the technical evaluation, Bitcoin stays in a strong uptrend. The weekly chart exhibits the value buying and selling firmly above each the 50-week SMA ($101,120) and the 200-week SMA ($53,830), that are thought-about main assist ranges by merchants.

The present worth sits round $121,457, holding above an important zone the place patrons have constantly stepped in.

Two key assist zones are marked on the chart: Simply above $118,000, and close to the $101,000 degree (the 50-week SMA). These ranges have reliably bounced Bitcoin from dips over the previous weeks, indicating robust market confidence. So long as BTC stays above these spots, the bull development stays intact.

BTCUSD Evaluation Supply: Tradingview

The Relative Energy Index (RSI) stands at 61.88, suggesting wholesome however not overheated shopping for exercise. This leaves extra room for added positive aspects earlier than a serious correction danger units in.

The MACD indicator can also be bullish, with the blue MACD line above the orange sign line, reflecting robust momentum for patrons. Buying and selling volumes have spiked, confirming investor curiosity at these essential worth factors.

Proper now, resistance sits close to $126,000 (the earlier excessive) after which at $135,000, the place technical evaluation suggests sellers might emerge. If Bitcoin breaks above $126,000 and holds regular, the subsequent transfer might simply goal $140,000, then the formidable $185,000 degree if Brandt’s “cycle break” concept performs out.

Above $140,000, worth discovery might speed up, powered by ETF inflows and provide squeeze dynamics.

Nonetheless, if Bitcoin stalls or pulls again this week, merchants anticipate the value would possibly retest the decrease assist zones at $120,000 and even $101,000 earlier than attempting to rally once more. The chance of a short-term reversal stays if the market treats current highs because the four-year cycle prime.

Bitcoin’s neara-term future shall be determined within the subsequent few weeks, both setting a brand new long-term excessive or pausing for a wholesome correction.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection