Be part of Our Telegram channel to remain updated on breaking information protection

Banks shall be pressured to supply clients higher yields to be able to keep aggressive as stablecoins start to growth, in response to Stripe CEO Patrick Collison.

Replying to a put up on X concerning the rise of yield-bearing stablecoins, Collison famous that the common rate of interest for financial savings accounts is 0.40% within the US and 0.25% within the EU.

“Depositors are going to, and may, earn one thing nearer to a market return on their capital,” Collison mentioned. “The enterprise crucial right here is obvious — low cost deposits are nice, however being so consumer-hostile feels to me like a shedding place.”

His remarks comply with Stripe’s launch of “Open Issuance” on Sept. 30, a brand new product by Bridge that allows firms to launch and handle their very own stablecoins with minimal friction.

GENIUS Act Prohibits Direct Stablecoin Yields, However Banking Teams See Loopholes

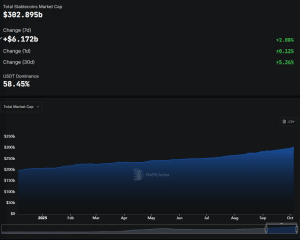

The stablecoin market has blossomed in current months, with the capitalization for the sector just lately hovering to a brand new report excessive above $300 billion. That is as extra establishments start to discover providing their very own tokenized choices to shoppers.

The stablecoin market’s development accelerated after crypto-friendly US President Donald Trump signed the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act into legislation in July, making a federal framework for stablecoins within the US.

Following the invoice’s signing, the capitalization of the stablecoin market has soared from round $253 billion to roughly $302.89 billion, knowledge from DefiLlama exhibits.

Stablecoin market cap (Supply: DefiLlama)

The GENIUS Act presently prohibits stablecoin issuers from providing customers yields immediately. Nevertheless, banking teams have identified that there are loopholes that don’t explicitly limit stablecoin issuers from providing yields by means of third occasion suppliers.

“Some lobbies are presently pushing, post-GENIUS, to additional limit any sorts of rewards related to stablecoin deposits,” in response to Collison.

Coinbase CEO Brian Armstrong posted a video on X on Sept. 29 after assembly with numerous lawmakers and trade executives, noting that banks try to push again on stablecoins, significantly potential yields that they might provide.

I’ve by no means been extra bullish about clear guidelines for crypto. It’s apparent that market construction is a freight practice that is left the station.

However that hasn’t stopped the massive banks from coming for an additional handout – this time paid by your crypto rewards. They need to undo your proper… pic.twitter.com/hmPYmagDhj

— Brian Armstrong (@brian_armstrong) September 29, 2025

“Banks need to ban rewards to keep up their monopoly, and we’re ensuring the Senate is aware of bailing out the massive banks on the expense of the American client is just not okay,” he wrote on X.

“All Forex” Will Turn into Stablecoins By 2030

Regardless of the pushback from banks, crypto executives see stablecoins as the following huge factor, and have even gone so far as to foretell that stablecoins will devour legacy fiat funds.

Amongst these executives is Tether co-founder Reeve Collins, who mentioned through the Token2049 convention in Singapore that “all forex shall be a stablecoin.”

“A stablecoin merely is a greenback, euro, yen, or, , a standard forex working on a blockchain rail by 2030,” he added.

“Each giant establishment, each financial institution, everybody needs to create their very own stablecoin, as a result of it’s profitable and it’s only a higher strategy to transact,” Collins mentioned.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection