Be a part of Our Telegram channel to remain updated on breaking information protection

The Uniswap value soared 28% over the previous 24 hours to commerce at $8.42 as of two:29 a.m. EST on buying and selling quantity that soared 584% to $3.3 billion.

This comes as Uniswap Labs with Uniswap Basis pushed a brand new proposal, UNIfication, which goals to reshape the decentralized alternate’s construction and future route.

The governance proposal submitted by Uniswap founder Hayden Adams seeks to activate protocol charges, introduce a UNI-burning mechanism, and realign incentives throughout the ecosystem.

At this time, I’m extremely excited to make my first proposal to Uniswap governance on behalf of @Uniswap alongside @devinawalsh and @nkennethk

This proposal activates protocol charges and aligns incentives throughout the Uniswap ecosystem

Uniswap has been my ardour and singular focus for… pic.twitter.com/Ee9bKDric5

— Hayden Adams 🦄 (@haydenzadams) November 10, 2025

The announcement boosted investor confidence, with the UNI token surging to a two-month excessive. In keeping with the proposal, on the launch of UNIfication, charges will apply to Uniswap v2 and main v3 swimming pools on Ethereum.

For v2, liquidity suppliers (LPs) will earn 0.25% per commerce, with 0.05% allotted to the protocol. For v3, governance will gather one-fourth or one-sixth of the liquidity supplier charges, based mostly on the payment tier.

The proposal requires a burn of 100 million UNI, price $842 million at present costs, from the Uniswap treasury as a retroactive burn. This represents the quantity that may have been burned if charges had been energetic because the protocol’s begin.

Uniswap might go parabolic if the payment swap is activated.

Even simply counting v2 and v3, with $1T in YTD quantity, that’s about $500M in annual burns if quantity holds.

Exchanges maintain $830M, so even with unlocks, a provide shock appears inevitable. Right me if I’m improper. https://t.co/39QjJsw9uQ pic.twitter.com/3FQzAmuOP3

— Ki Younger Ju (@ki_young_ju) November 11, 2025

The proposal brings in permanency into the expansion funding mannequin, as from 2026 the agency governance would allocate a 20 million UNI yearly funds.

The proposal, if accredited by the DAO, would set a brand new precedent for decentralized decision-making.

Can the proposal nonetheless push the value of UNI greater?

Uniswap Worth On A Restoration, Goals For A Rally Over Key Resistances

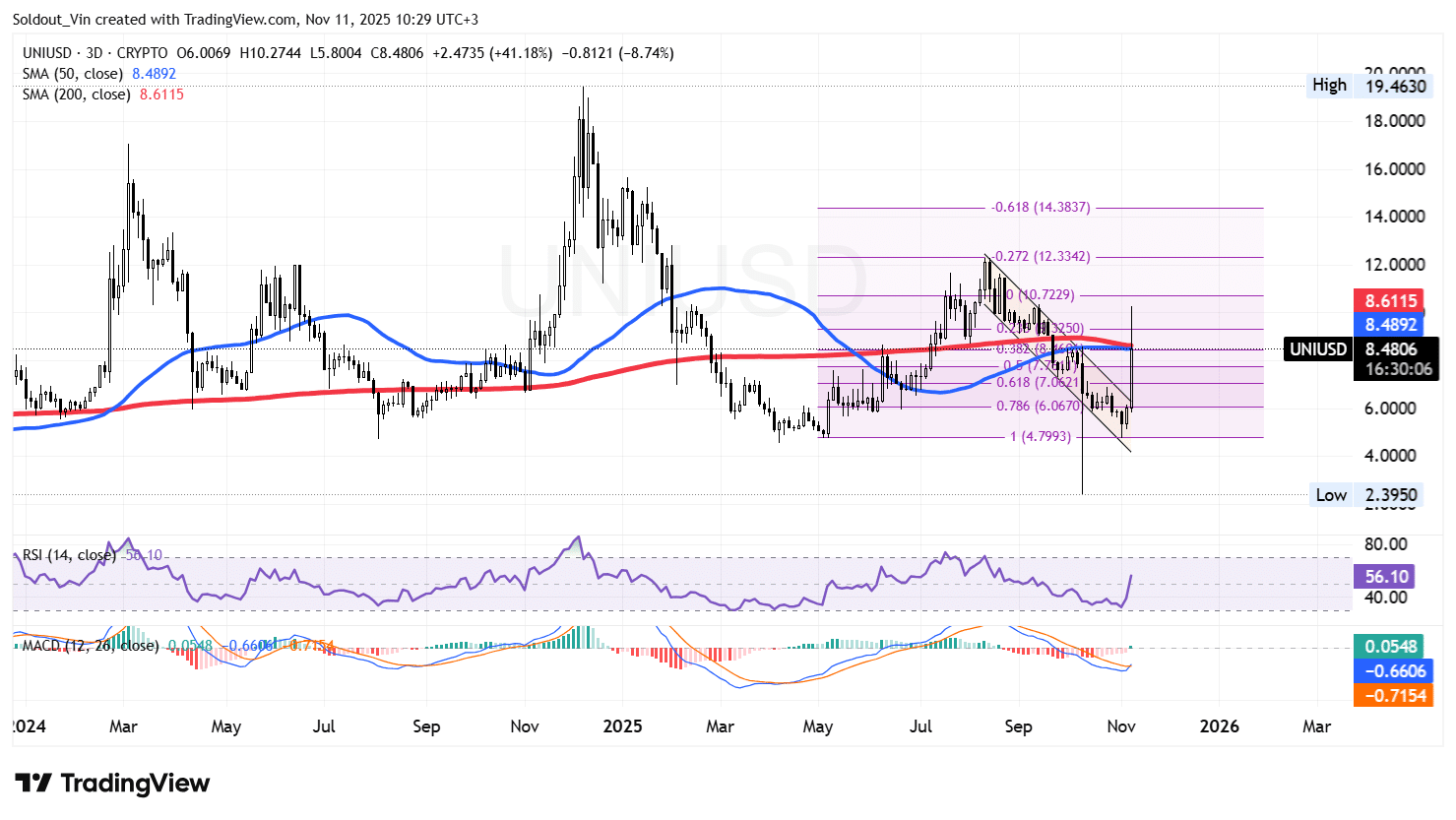

The UNI value, after bottoming in Could inside the $4.79 help, went by means of a sustained surge to clear main resistances.

The surge allowed the Uniswap value to hit an area excessive of $12.29, as indicated on the Fibonacci retracement ranges.

After hitting this resistance, the value of UNI went by means of a retracement, buying and selling inside the confines of a falling channel sample, because the bears took benefit of the demise cross that had earlier fashioned on the $8.28 degree.

Nevertheless, after hitting the $4.79 help once more, and on account of the governance proposal, the value of the Uniswap token has since recovered above the higher boundary of the falling channel. The newest 3-day candle is hovering above main resistance on the Fibonacci retracement degree.

On account of the propelled costs, UNI crossed above each the 50-day and 200-day Easy Transferring Averages (SMAs) on the 3-day timeframe, cementing the general bullish outlook, however has since settled barely under the value.

In the meantime, the 50-day SMA ($8.488) is closing in on the 200-day SMA ($8.611), which might lead to a golden cross. This might additional enable the bulls to push the value even greater.

The Relative Energy Index (RSI) additionally helps the bullish rally, with the RSI recovering under the oversold ranges, to now cross above the 50-midline degree, at the moment at 55.82, as momentum picks up.

Furthermore, the Transferring Common Convergence Divergence (MACD) has turned constructive, with the blue MACD line now crossing above the orange sign line, however stays below the zero line. This helps the rally whereas cautioning merchants of minimal bullish indicators.

UNI Worth Prediction: Bulls Eye $10 And Above

In keeping with the UNI/USD chart evaluation on the 3-day timeframe, all indicators, together with the RSI and the MACD traces, level to a sustained bullish rally.

If the UNI value crosses above the 0.382 Fibonacci degree at $9.41, the subsequent potential costs are above the $10 degree, with the subsequent key help degree on the 0.236 Fib degree at $10.52 and the 0 Fib degree at $12.29.

Conversely, if the present rally is short-lived and sellers begin to take earnings, the Uniswap value might retrace again to the $0.618 Fib degree at $7.66 or the 0.786 Fib degree at $6.4 inside the boundaries of the falling channel.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection